Account Updater Response Reports

December 9, 2024

Description

How to download Account Updater response reporting and interpret codes

Download the Response Report

You can download Account Updater reports from Business Advantage 360 online banking Merchant Services account. These reports are also called response files. You can download this report three to five days after your harvest date and see each token that was updated by Account Updater. (See below the Report Response Codes section for more information on the information provided by the report.)

- To download a report/response file

- Log in to your Business Advantage 360 online banking Merchant Services account.

- On the left navigation, select Reports > Downloadable Reports > Available Reports.

- Select the Third-Party Reports tab.

- Account Updater generates reports if changes occur and titles them based on your merchant ID: XXXXXXXX.au.response.ss.csv or amex.XXXXXXXX.au.reponse.ss.csv.

- You can search for your Account Updater reports using your MID and the date range you choose.

- In the Download column, click the file format link.

- Follow your browser's instructions to open and save the file.

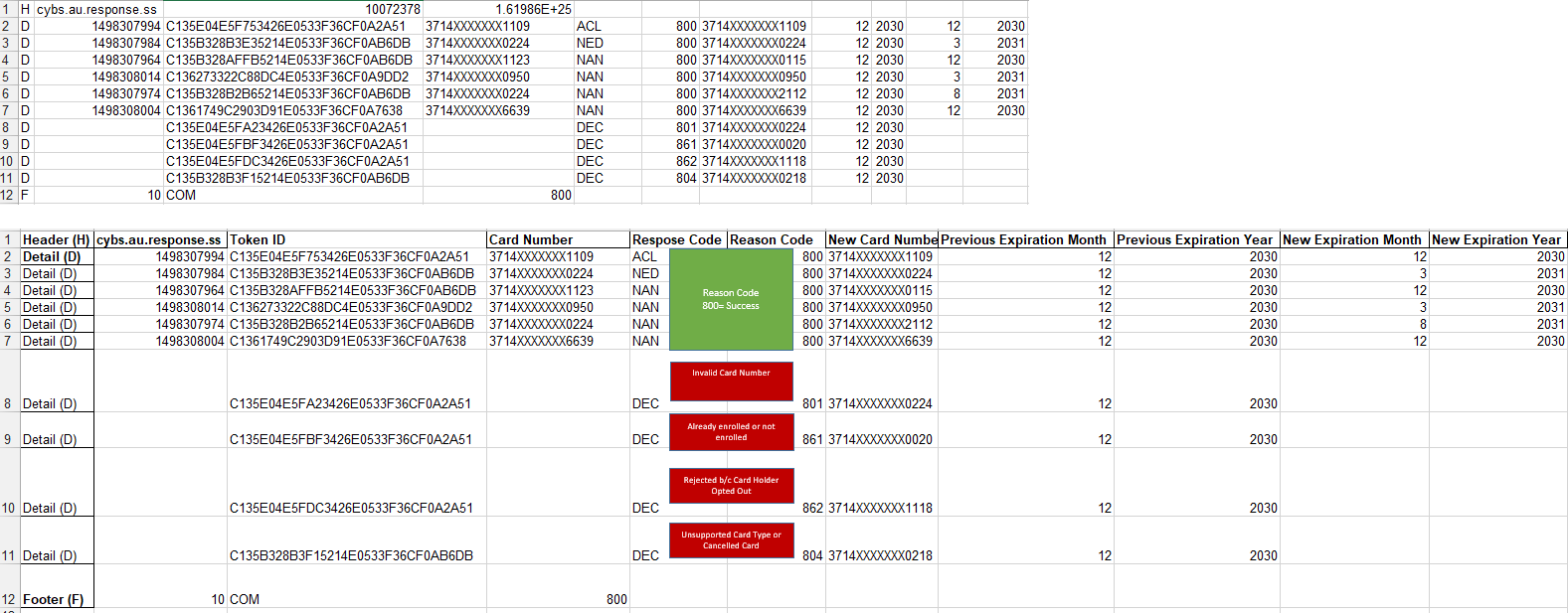

- Response File Examples

- Account Updater response codes

The following table describes response codes that may appear in your response file and what you should do if action is needed.

Account Updater report response codes, definitions, fee, actionResponse

Code | Description of Response Code | Fee | Token update | Merchant Action |

|---|

| ACL | 800 - Success

Match Account Closed | Yes | The instrument identifier (card number) token is amended and marked as closed

Action:

Do not include the token with the next batch update request. Update the system to indicate the account was closed. If new card number obtained, create a new token. You will need all 16 digits of the card number and the expiration date. |

| CCH | 800 - Success

Contact Card Holder | Yes | No automatic updates are made to Token Management

Action:

Do not include the token in the next batch update request. Contact the card holder to obtain new credentials, then create a new token. |

| CUR | 800 - Success

Card Data Current | No | No changes are made. |

| NAN | 800 - Success

New Account Number | Yes | The original instrument identifier (card number) is closed and a new instrument identifier token is created within the Customer token |

| NED | New Expiration Date | Yes | The payment identifier (expiration date) token is amended with the new expiration date |

| NUP | 800 - Success

No Match, No Update | No | N/A |

| DEC | 801- Invalid Card #

805 - Invalid Card Type Length

806 - Unknown Card Type

851 - Invalid Token Length

852 - Unknown Token

853 - Token Closed Previous AU Batch

861 - Cardholder is already enrolled

862 - Rejected Card-holder opted out | No | N/A |

| ERR | 801 – Invalid Card #

802 - Invalid Check Digit

803 - Invalid Expiration Date

804 - Unsupported Card Type or Cancelled Card

807 - Merchant not enrolled properly in AU

808 - Incorrect Record Indicator

809 - Unknown Error Code

811 - New Account Number failed Mod 10 check

820 - Card number rejected by Token Provider

821 - Token Provider Issue | No | N/A |