American Express Direct

August 15, 2024

Description

An overview of American Express Direct, how to add it to your account, and how transactions, statements and tax reporting will differ

American Express offers two processing options for merchants: OptBlue and Direct. OptBlue is the standard American Express product offering for Bank of America's Merchant Services clients. Processing, settlement and disputes for OptBlue merchants, on the Bank of America platform, are handled the same way as other card brands such as MasterCard and Visa.

For Bank of America clients who choose the simplified pricing plan, the cost of processing American Express OptBlue transactions is the same as MasterCard/Visa costs. Those costs are based on how the payment is taken: card present, card not present manually keyed, or card not present online.

For some clients, American Express Direct (Amex Direct) may be required. When processing through a Direct relationship, American Express will manage the fees (except the Authorization fee), disputes and settlement activity for you.

In some situations, American Express may decline a merchant for OptBlue processing and the merchant will be referred to American Express to establish a Direct relationship, if desired. To contact American Express, call 800.528.5200.

American Express processing is assigned at the location level, so you may have a location on the OptBlue option and a location with a Direct account.

Add American Express Direct

- Bring your Direct account to Bank of America

If you have already established your Direct relationship with American Express, prior to creating your Merchant Services account through Bank of America, let your Merchant Consultant know and provide your Service Entitlement number during onboarding.

- Declined for OptBlue during onboarding

Establish your Direct relationship with American Express by calling American Express at 800.528.5200. American Express will supply the new Service Entitlement number for the Direct account to you. Once the Service Entitlement number is obtained, contact the Merchant Consultant who originally assisted you and provide your Service Entitlement number to request that American Express Direct be added to your account.

If you are not sure if you already have an established Direct account, contact American Express at 800.528.5200.

American Express Direct transactions, disputes, statements and 1099-K

- Direct transactions in online banking

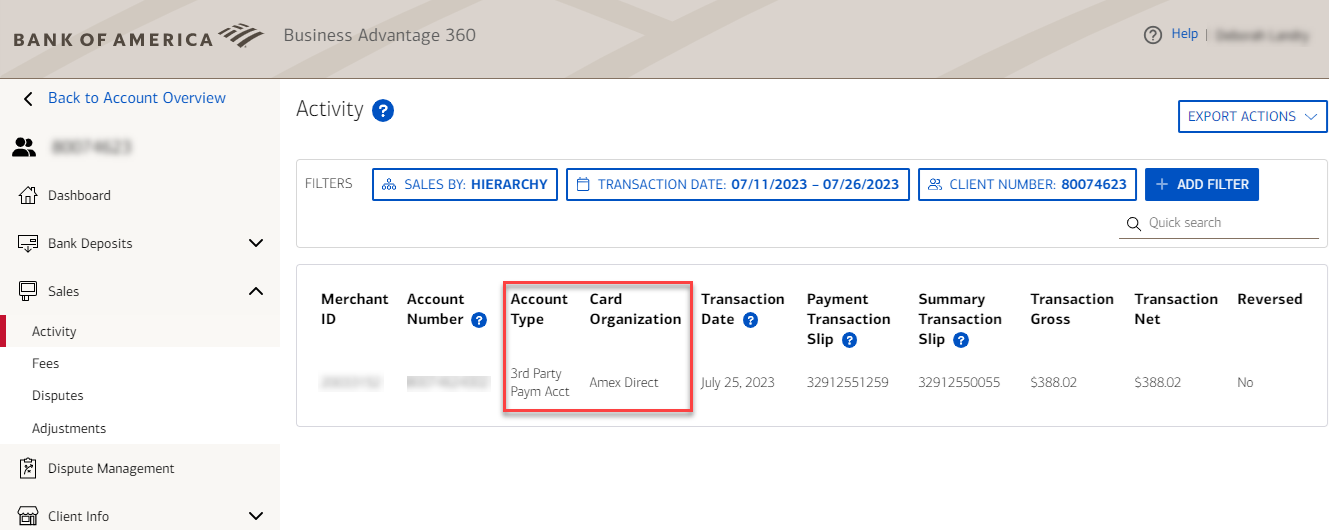

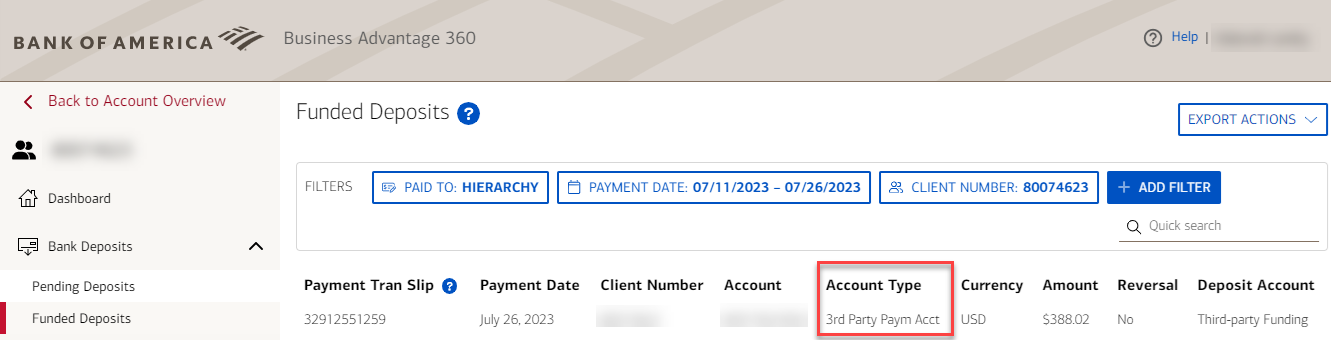

When processing through Direct, transactions viewed in your Merchant Services Sales Activity in online banking will show the Account Type as 3rd Party Paym Acct and the Card Organization will indicate Amex Direct. Your Funded Deposits view for those transactions will show the Deposit Account Type as Third-party Funding.

- Direct transactions on your statement

Your statement will show all sales activity for your transactions including Amex Direct. Funding amounts on the statement will not include the Amex Direct transactions.

- Direct transaction disputes

Disputes and chargebacks related to American Express Direct are handled through American Express.

- Direct transactions on end of year tax reporting

The Bank of America 1099-K statement will not include the Direct transaction volume in the yearly gross reportable sales calculation.