Bank of America Gateway Integration Methods Overview

Description

What's in this article?

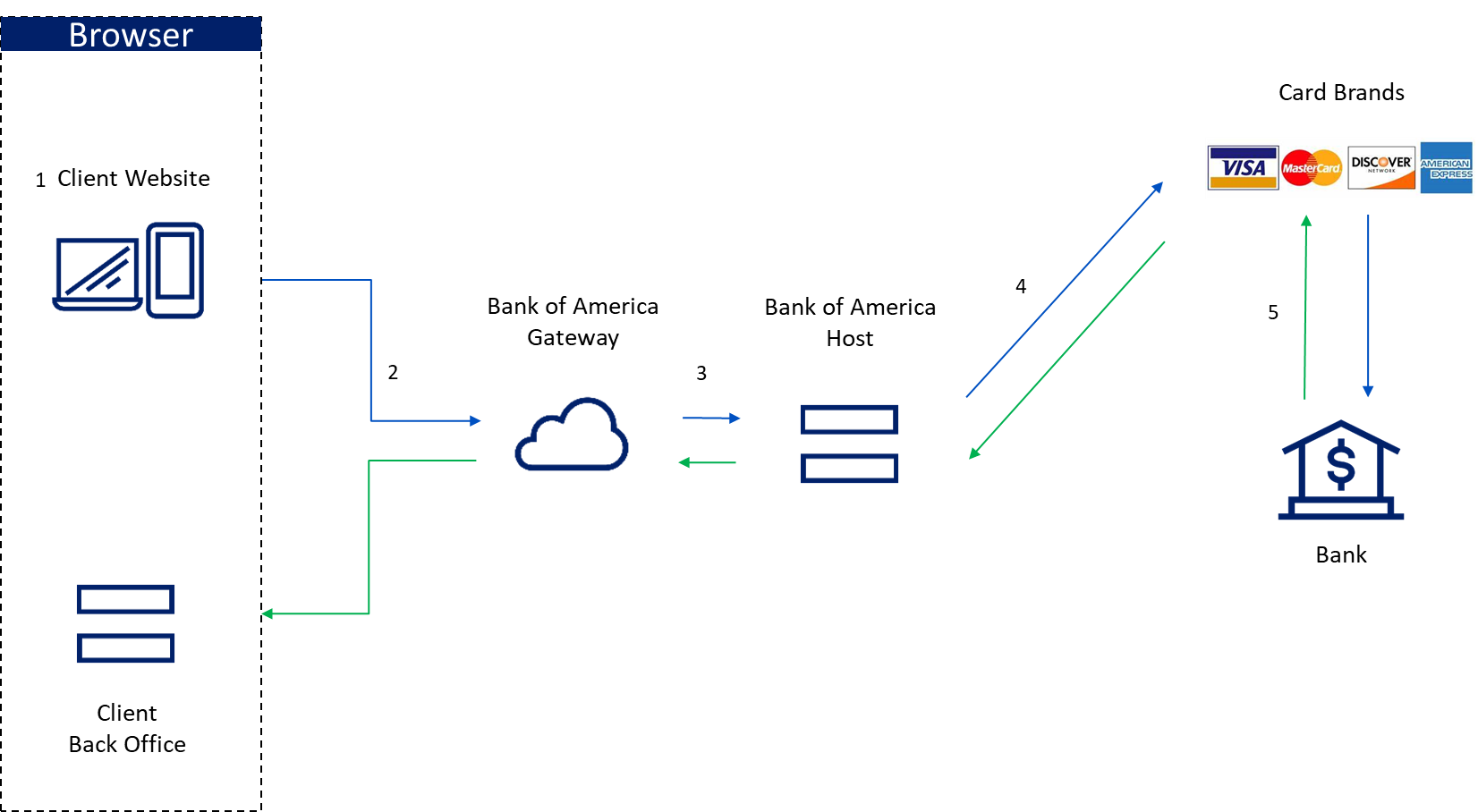

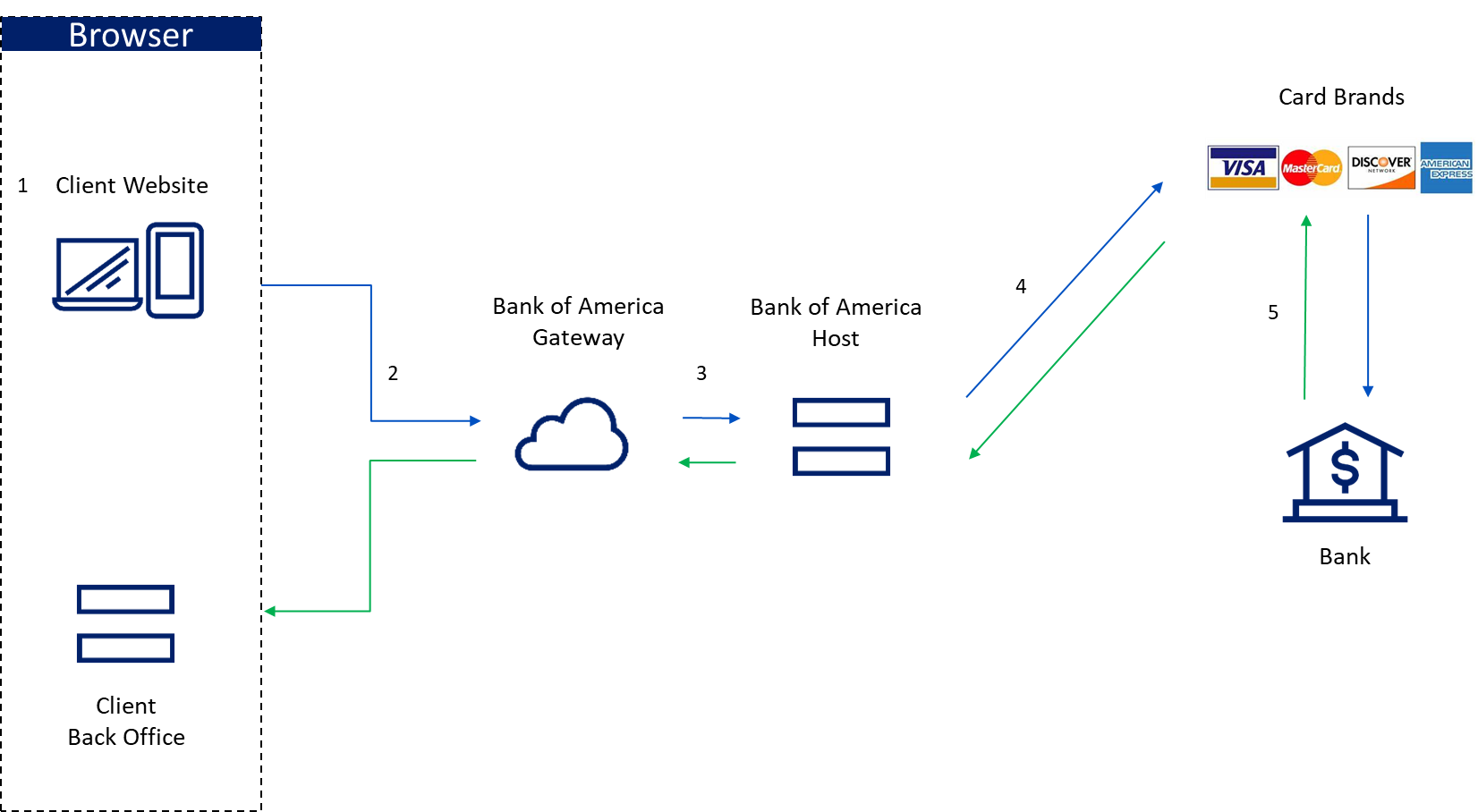

Bank of America offers four types of integration methods to connect to the Bank of America Gateway for card not present payment transactions (e-commerce). Each method requires coding development by an integration developer. An existing website with a custom (non-third party) shopping cart built by a developer is needed in order to integrate to the Bank of America Gateway.

IMPORTANT!

An integration to the Bank of America Gateway should not be used with payment plugins. Using payment plugins can prevent transactions from reaching the Bank of America Gateway.

An overview of each of these integration methods is provided below:

| Descriptor type | Hosted Payments Page | Checkout API | Microform Integration | Card Not Present Integration Toolkit |

|---|---|---|---|---|

| Complexity | Least complex | More complex | Increasingly complex | Most complex |

| What it is and how it works | Provides a checkout web form to handle payments made with credit/debit cards. Handles all payment data security and transaction processing. | Similar to HPP, provides a seamless and secure checkout experience. Allows the payment page to be customized with branding. | Provides a secure iFrame (pop up window) to collect customer card data. Bank of America hosts the iFrame and transmits the card data through the secure single-use token API. | Provides control of the entire checkout experience (i.e., everything the end-user sees) including the payment form, the response pages and the receipt. |

| Integration effort | Some coding required | Considerable coding required | More extensive coding required | Most extensive coding required |

| Level of checkout control | No control of the checkout experience | Little control of the checkout experience | More control of the checkout experience | Most control of the checkout experience |

| Customization allowed | Little customization | Customizable checkout form | Customizable experience | Fully customizable |

| PCI burden | Reduced scope for PCI | Reduced scope for PCI | Reduced scope for PCI | Largest PCI scope |

The implementation requirements and transaction flow for each integration method is provided below:

A Demonstration & Certification Environment (DCE) is available, giving developers the ability to test their integration in a test environment prior to going live with a website. For HPP and Checkout API integrations, Secure Acceptance profiles and security keys are required in order to send transactions to the test environment. Microform Integration and CNP Integration Toolkit integrations require security keys. To learn more about the DCE and generating security keys, refer to Demonstration & Certification Environment (DCE) Testing.

To learn more about these four types of integration methods to the Bank of America Gateway, refer to the Bank of America Gateway Integration Guide.