Back Office Taxes Report

Description

How to run the Taxes report in the Back Office

What's in this article?

Solution: Essentials Light | Essentials | Retail | Restaurant

Use the Taxes report to see sales by individual tax rates and tax jurisdictions. You can generate this report and send it to your accountant for tax filing. If you sell at multiple locations, this report will break down the tax information for each of your selling locations with sales for the selected date range.

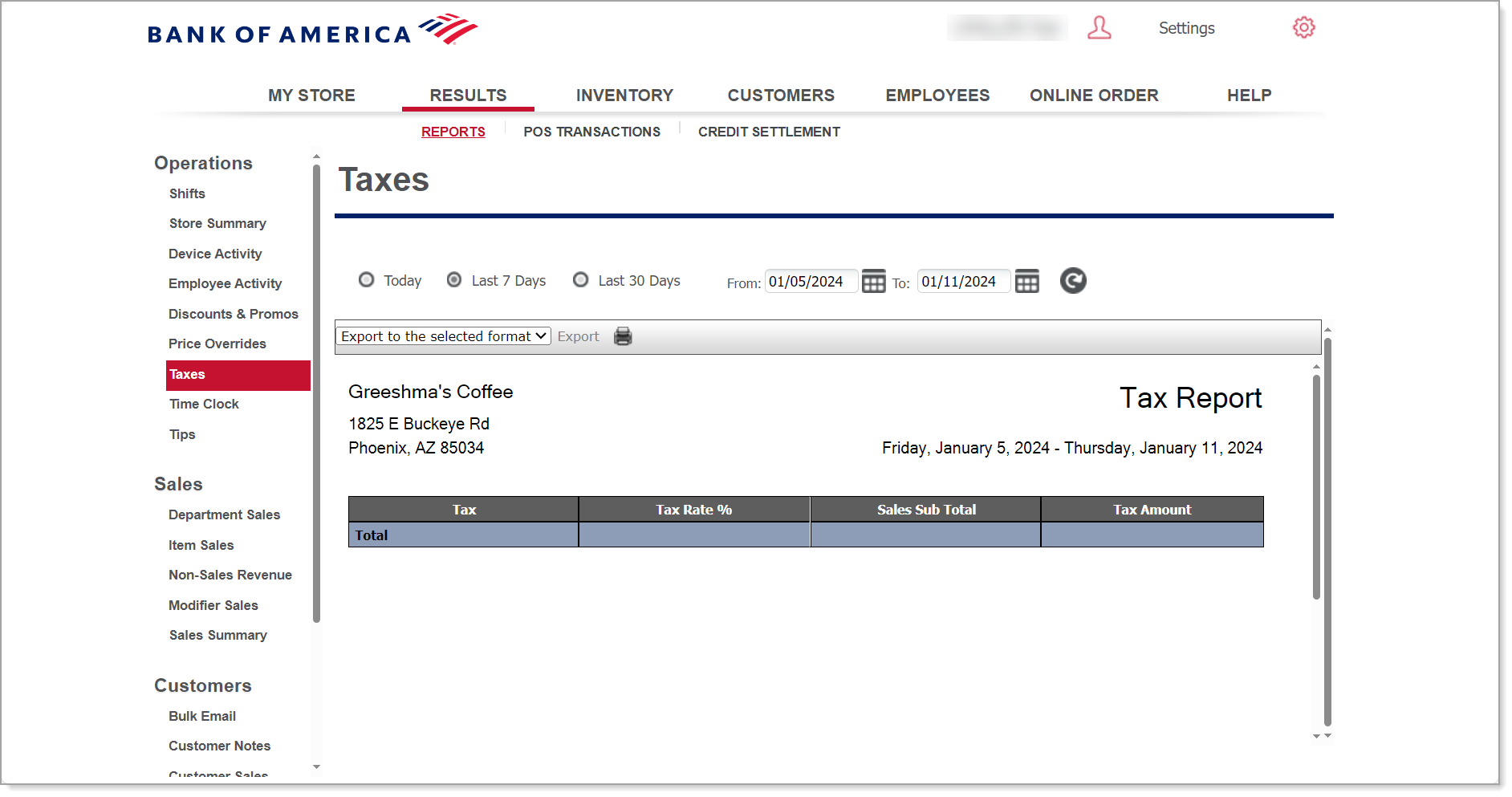

To run the Taxes report

- In the Back Office, select the Results tab.

- Select the Reports subtab.

- In the left navigation, select Taxes.

- Select your date range.

- Click refresh to generate the report.

This report shows you:

- The Sales Sub Total: This is the sales you made for items in each tax category. It does not include the tax.

- The Tax Amount: This is calculated by multiplying the Tax Rate % by the amount in the Sales Sub Total column. If the Tax Amount does not equal the Tax Rate % multiplied by the Sales Sub Total, it is because of a tax override that occurred at the point of sale.

- Breakdown by selling location: This will be in the report if the date range selected includes multiple selling locations.

- Breakdown by tax jurisdictions: This will be in the report if the date range selected includes multiple tax jurisdictions.