Merchant Services Dispute Management

Description

What's in this article?

A dispute (also known as a chargeback) is a transaction reversal meant to serve as a form of consumer protection. It takes place after a customer disputes a card transaction. Disputes generally occur when a customer believes that the transaction was not authorized or was not satisfied with the product or service provided by the merchant. A dispute can move through many stages that can vary by card brand or type and can be for the full or a partial amount of the transaction.

When an issuing bank initiates a dispute or if a dispute moves to a new stage, you will be notified in an emailed alert and a case will be created in Business Advantage 360 Disputes Management about the disputed transaction. It is your responsibility to monitor, update, and respond to disputes within the required timelines.

Why should I respond?

When a dispute is initiated, your account will be debited immediately. If you fail to respond to the dispute within the agreed upon timeframe, you are agreeing to the dispute.

Access Dispute Management

As a business owner or user with full access to your Merchant Services account within Business Advantage 360, you can access Dispute Management to view and respond to disputes or chargebacks.

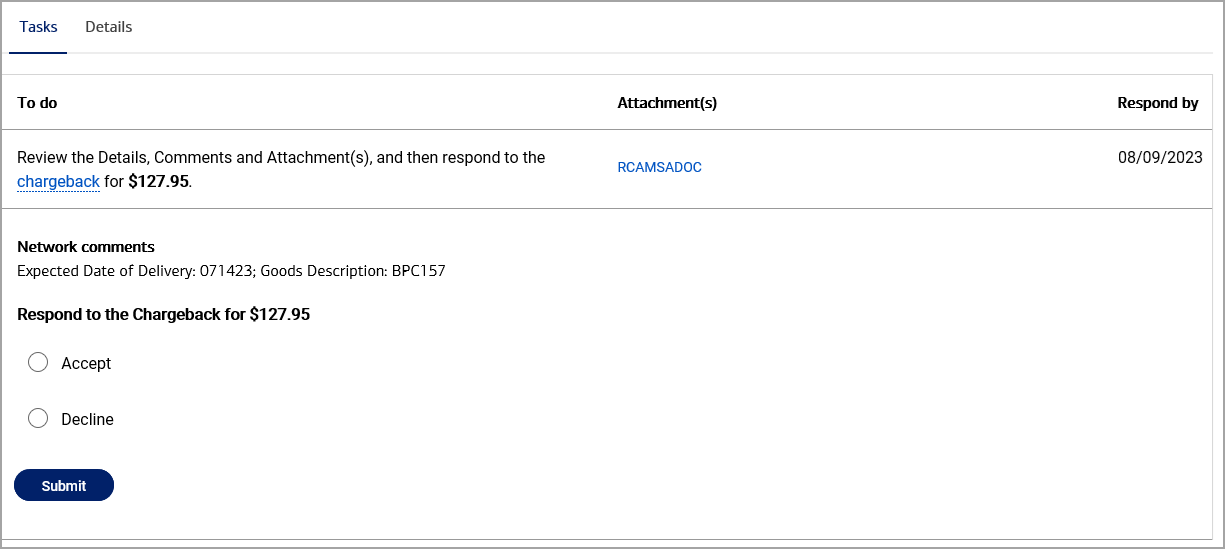

To learn more information about a dispute prior to choosing a response, select the Dispute Questionnaire, Details, and Task tabs.

Respond to a dispute

When you select Dispute Management, the Case View defaults to disputes that require action, ordered by Respond By date with the oldest cases first. You can also view cases that are under review or closed by selecting from the Case Status menu. Cases under review are ordered by Respond by date while closed cases are ordered by case ID. Dispute responses are time sensitive. Responses and supporting documentation must be submitted in English.

Expired Response Timeframe

Try to respond to your disputes as soon as possible. Responding to chargebacks promptly is critical for fair dispute resolution. Card networks set strict, non-negotiable timelines for submitting evidence and closing cases. These deadlines cannot be changed by the bank, so any delay in providing documentation can result in an automatic loss, regardless of evidence strength. If the timeframe to respond to the dispute has passed, you will receive a warning message when you respond. It may still be possible to attempt to submit your response to the Card network, although there is a risk that your response may be rejected.

NOTE:

Disputes may be resolved in favor of the cardholder if documentation isn’t submitted on time. Respond promptly to prevent automatic closure of the dispute.

To continue, accept the acknowledgement of risk and liability and then click Continue to proceed.

Dispute attachment guidelines

Ensure that your attached documentation is clear and legible and provide supporting documents in a supported file type. The file name cannot contain special characters (~ ` ! # % & = ,). Do not submit password protected files.

The file size of the attachments you provide when rejecting a dispute must conform to card brand requirements for file type and size. There is a maximum file size for each file and a maximum total file size for all the attachments. Files cannot be removed once uploaded and additional documents cannot be added once the response is submitted.

Documents Submitted in Error Cannot Be Deleted

Once you click the Upload button, files cannot be deleted. If you have not uploaded the case, you can attach the correct file. Before submitting, please add additional comments advising of the incorrect file. If you have already submitted the case, please contact us at 833.344.2324.

| Card Type | Max. Individual File Size | Total File Size Max. | File Type |

|---|---|---|---|

| Visa | 2MB PDF | 10MB | .tiff, .jpeg, .pdf |

| MC | None | 15MB | .tiff, .jpeg, .pdf |

| Amex | 1MB | 10MB | tiff, .jpeg, .pdf, .mtif, .txt, .xls/xlsx, .doc/docx |

| Discover | None | 15MB | .tiff, .pdf |

| PIN Debit | None | 10MB | .tiff, .jpeg, .pdf |