Back Office EBT Setup in Retail Solution

November 14, 2025

Description

How to set up EBT as an accepted payment method

Solution: Retail

Retail Solution may accept EBT SNAP payments for EBT-eligible items. To accept EBT SNAP as a form of payment, you must have a Food and Nutrition Service (FNS) number. Learn more about EBT eligibility.

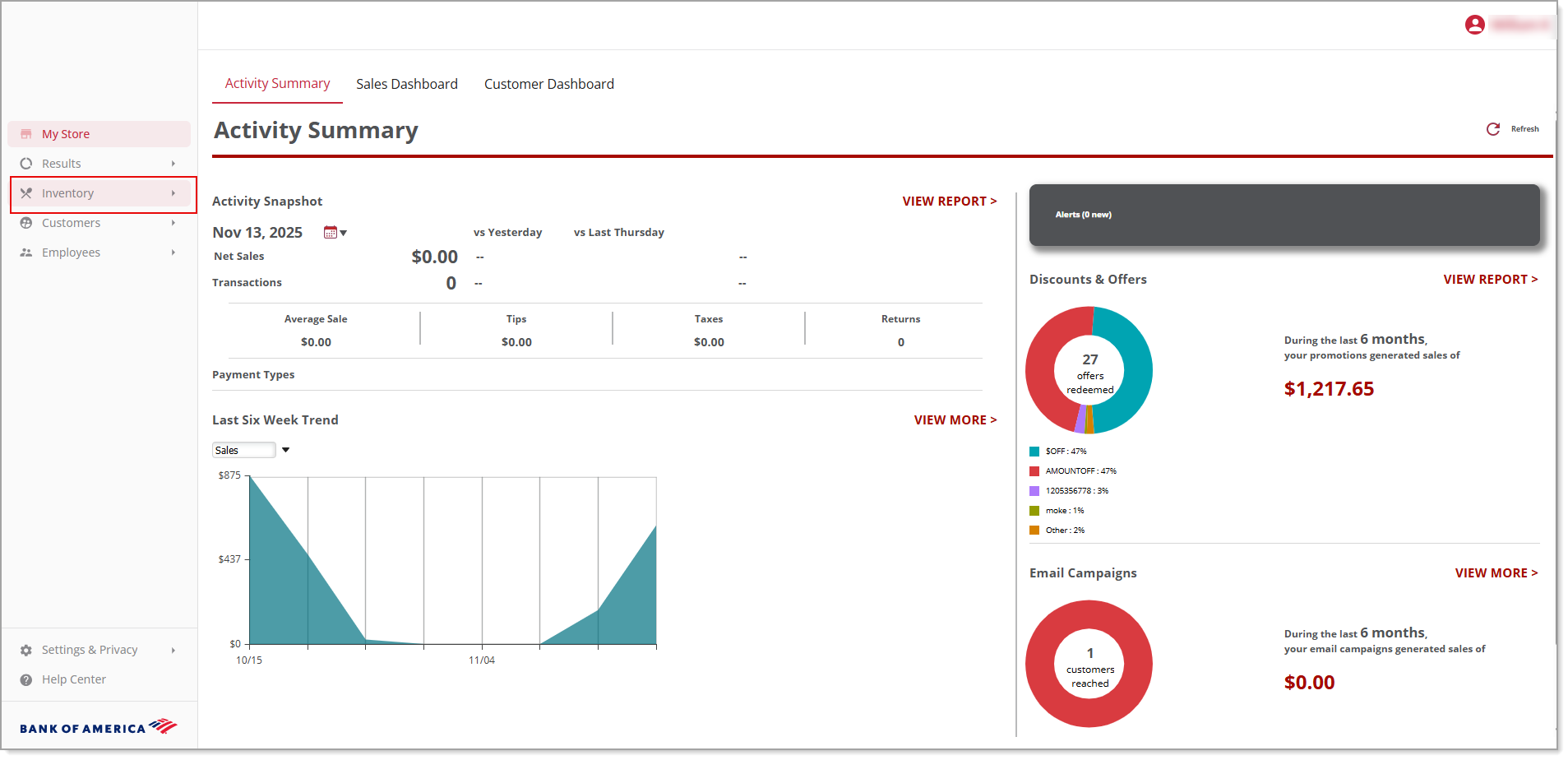

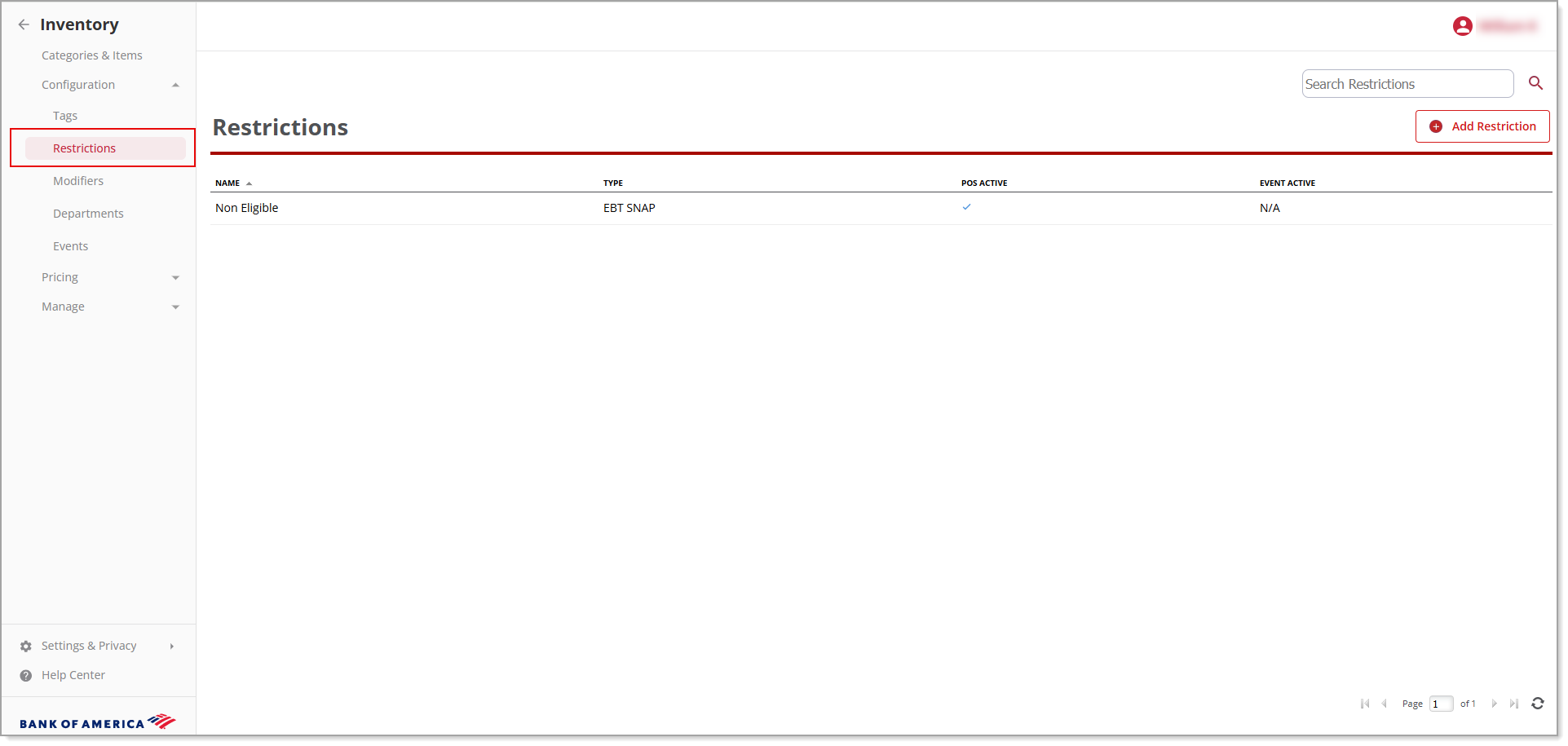

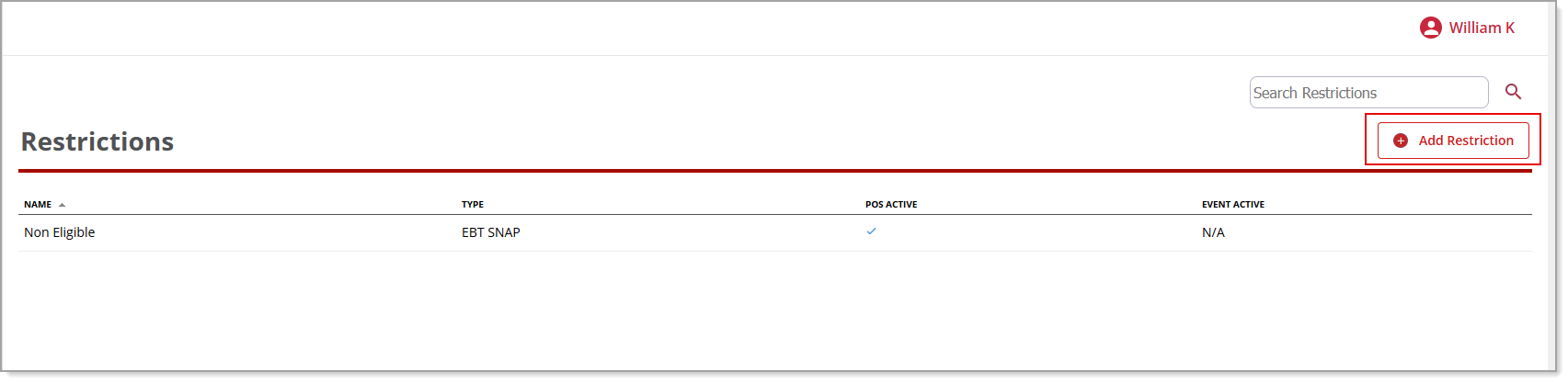

Back Office setup

To accept EBT payments, enable EBT SNAP in the Back Office. Once chosen as an form of payment at the time of sale, affected EBT items will have their attached tax values dropped to 0% in alignment with the EBT payment rules.

IMPORTANT!

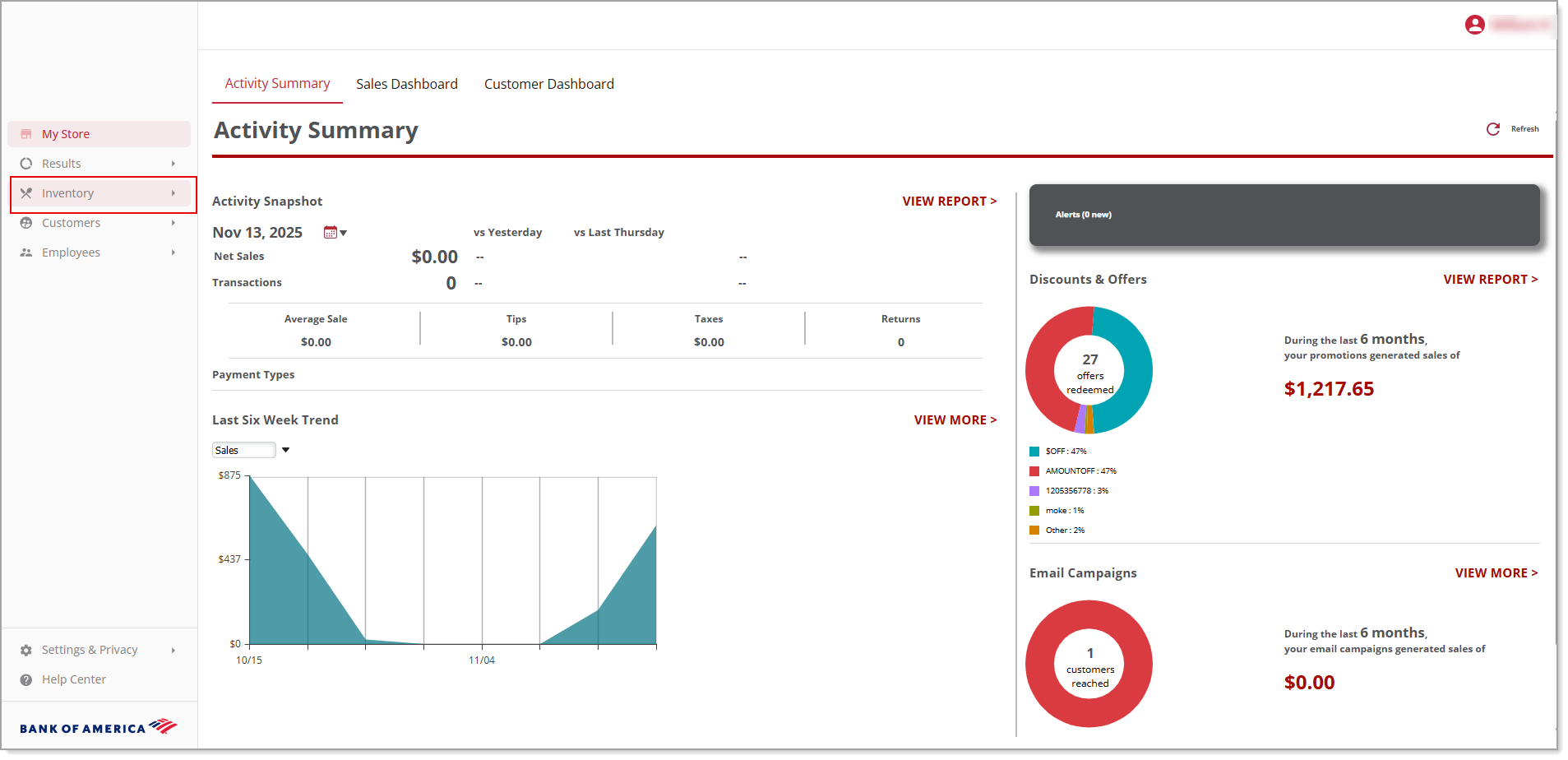

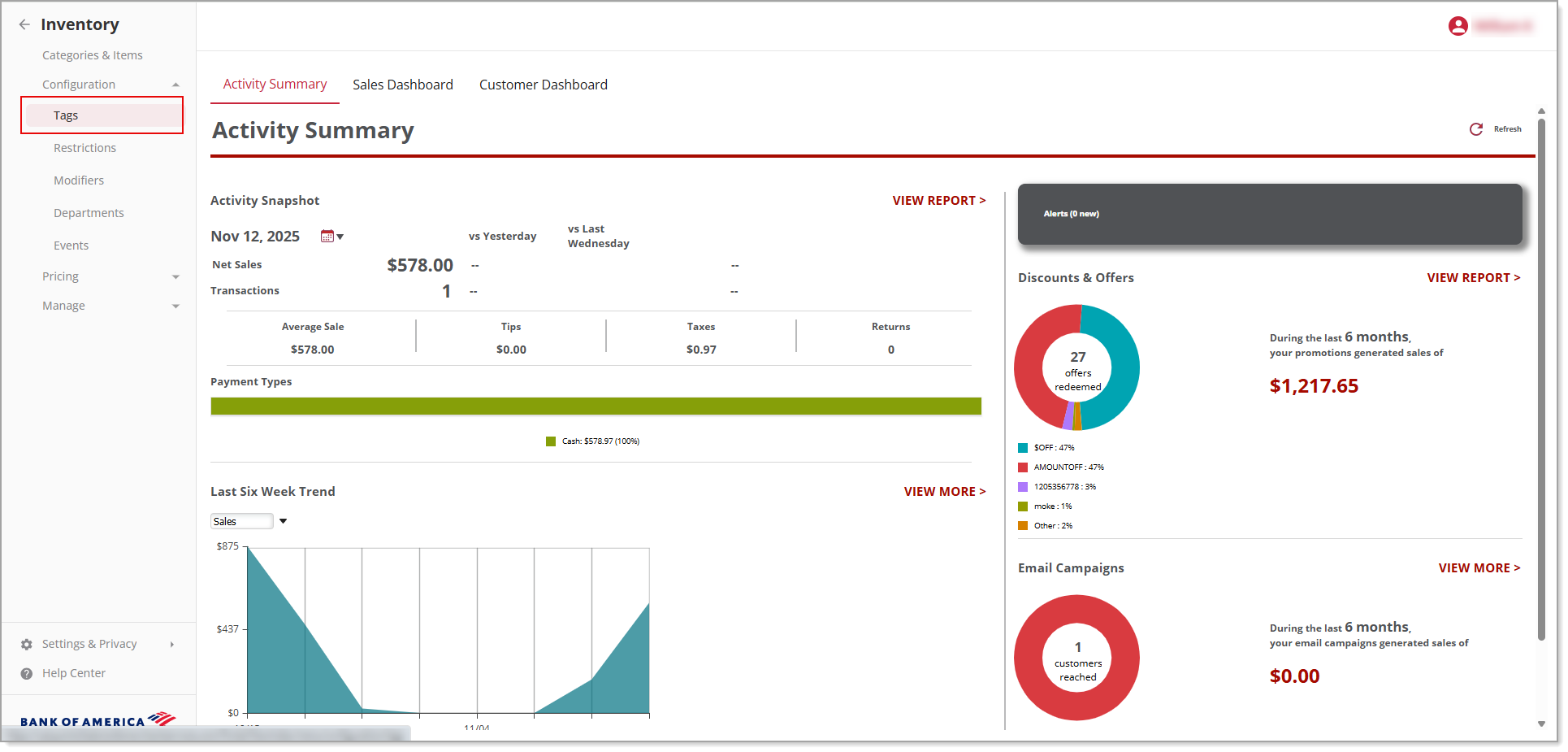

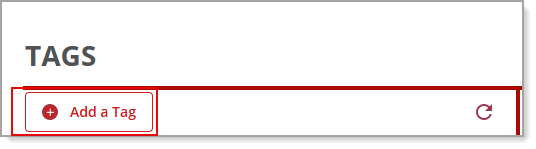

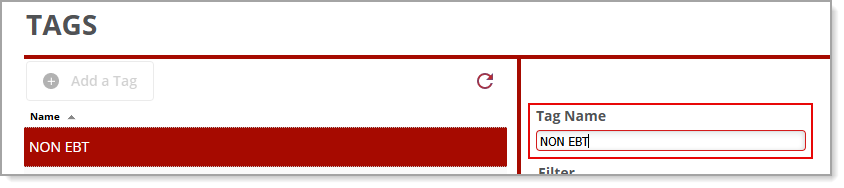

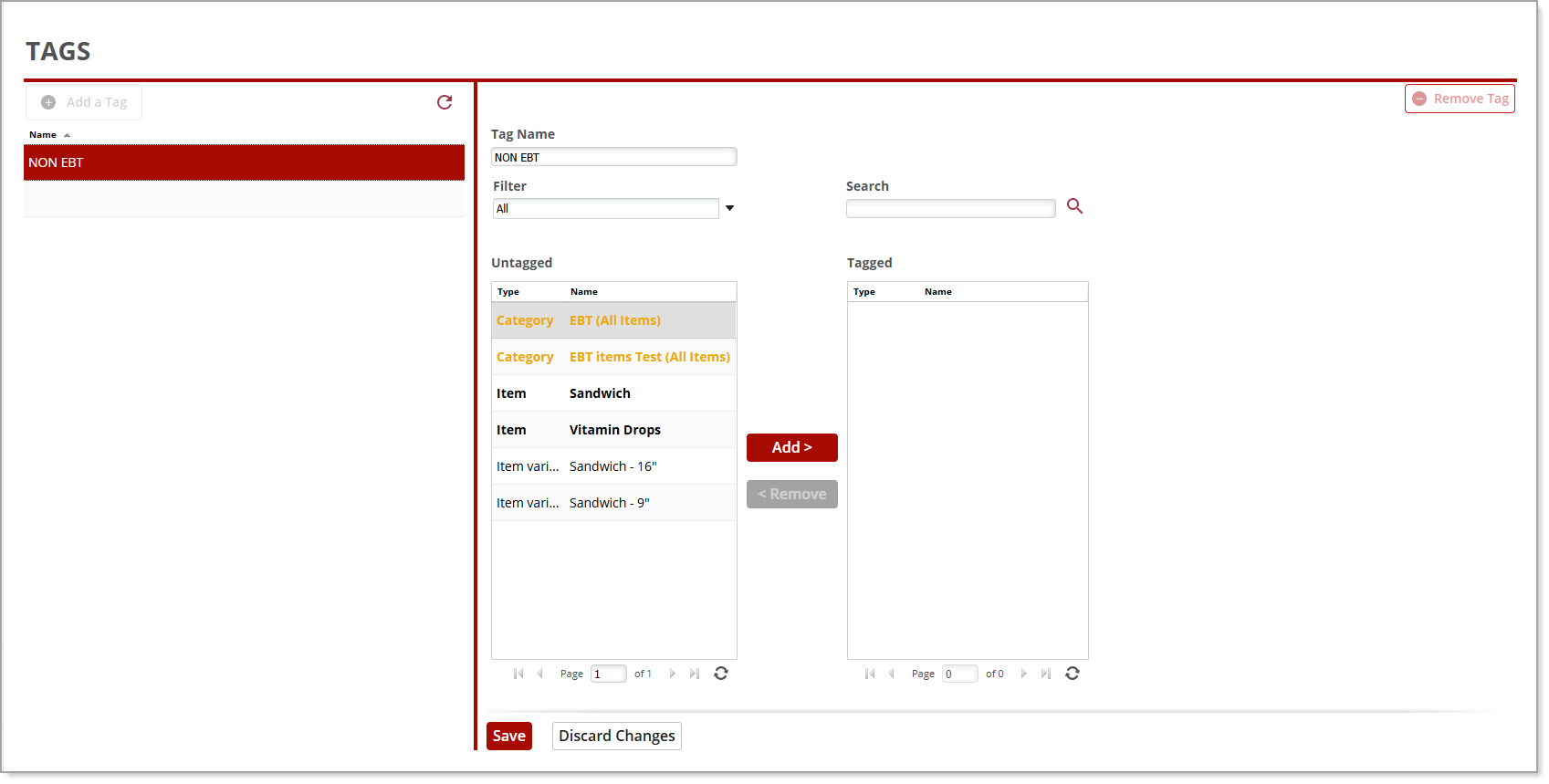

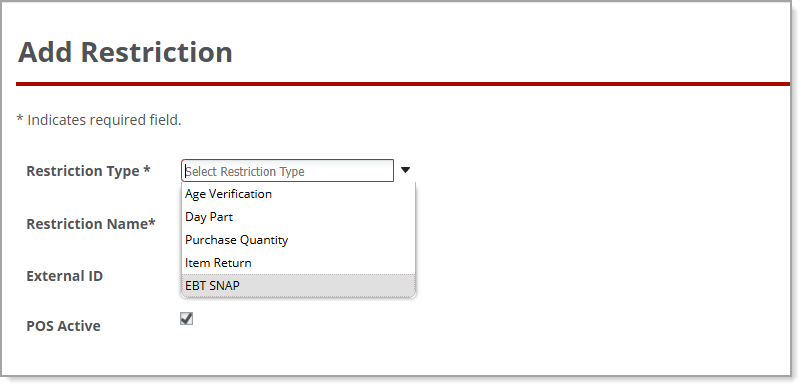

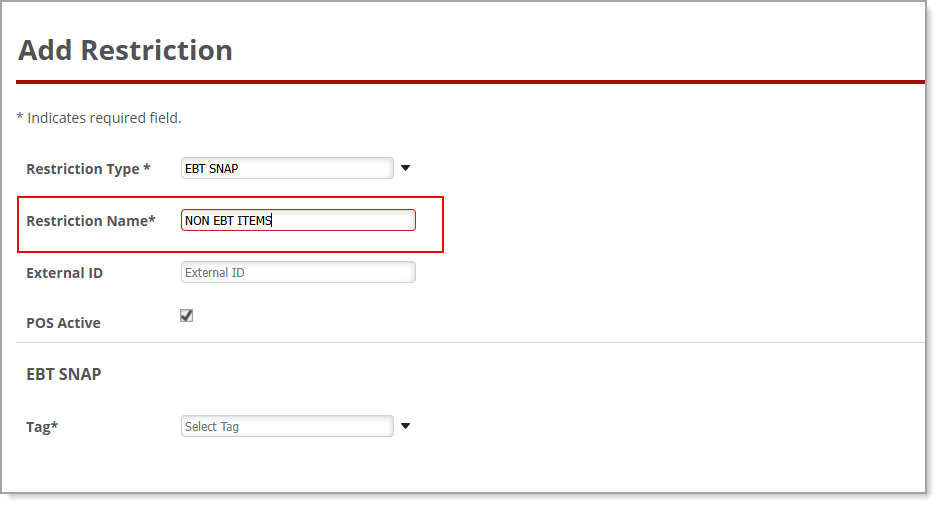

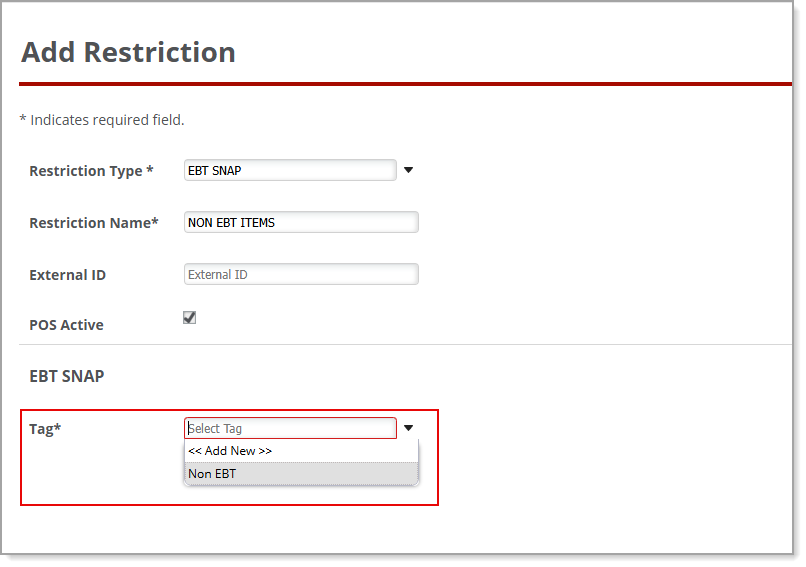

When you enable EBT SNAP under Payment Methods, all items will be marked as EBT Eligible within the system. Tag your non-EBT items and mark them with restrictions to set them apart from your EBT SNAP-eligible items.

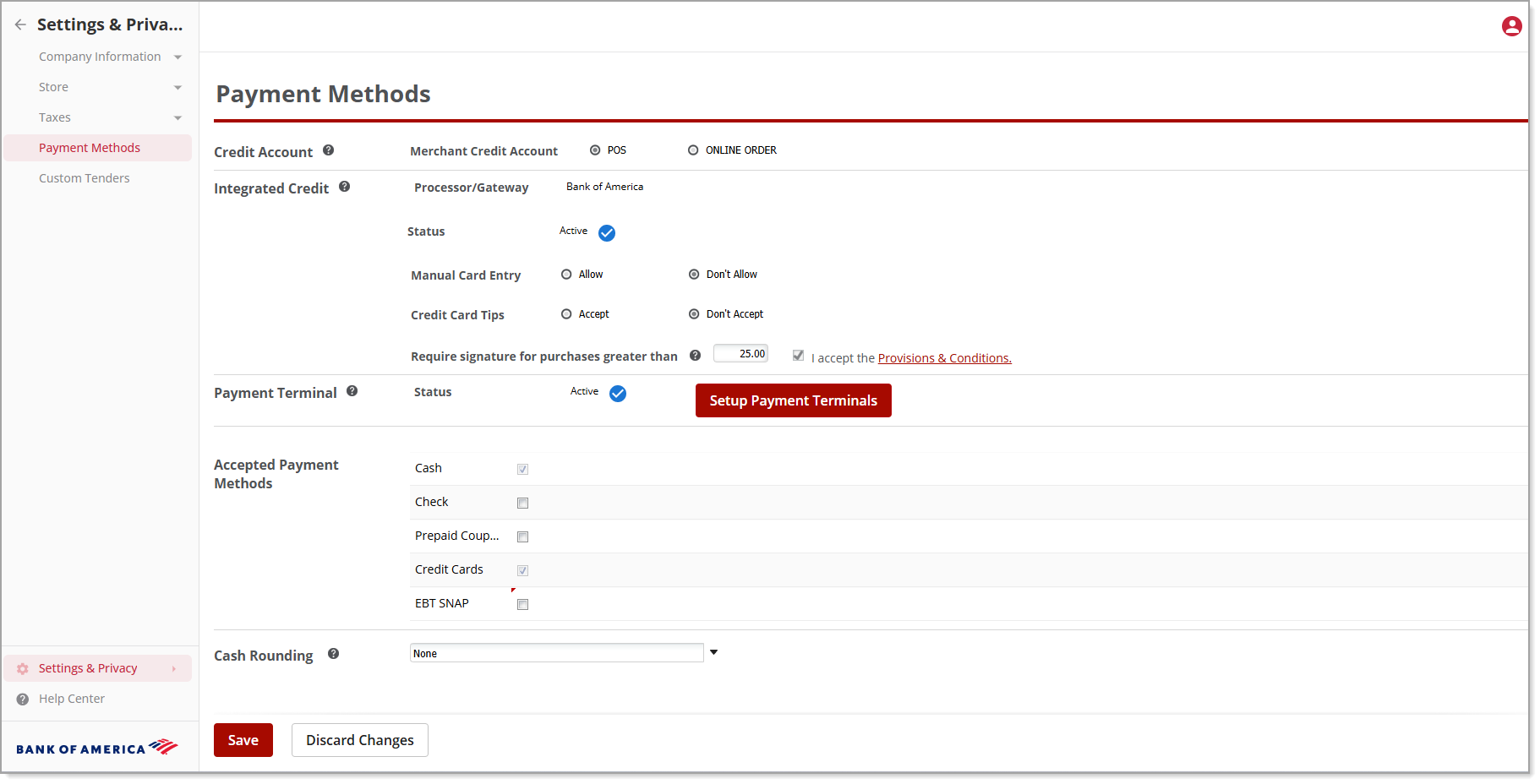

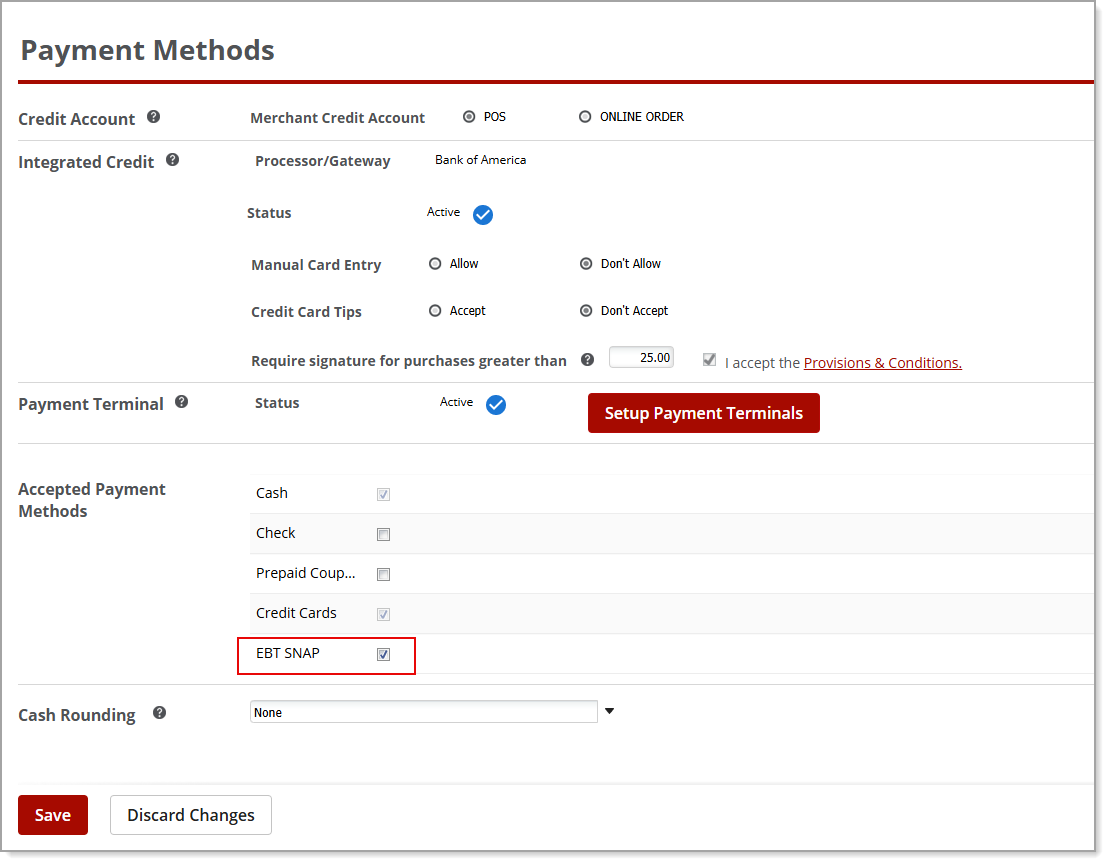

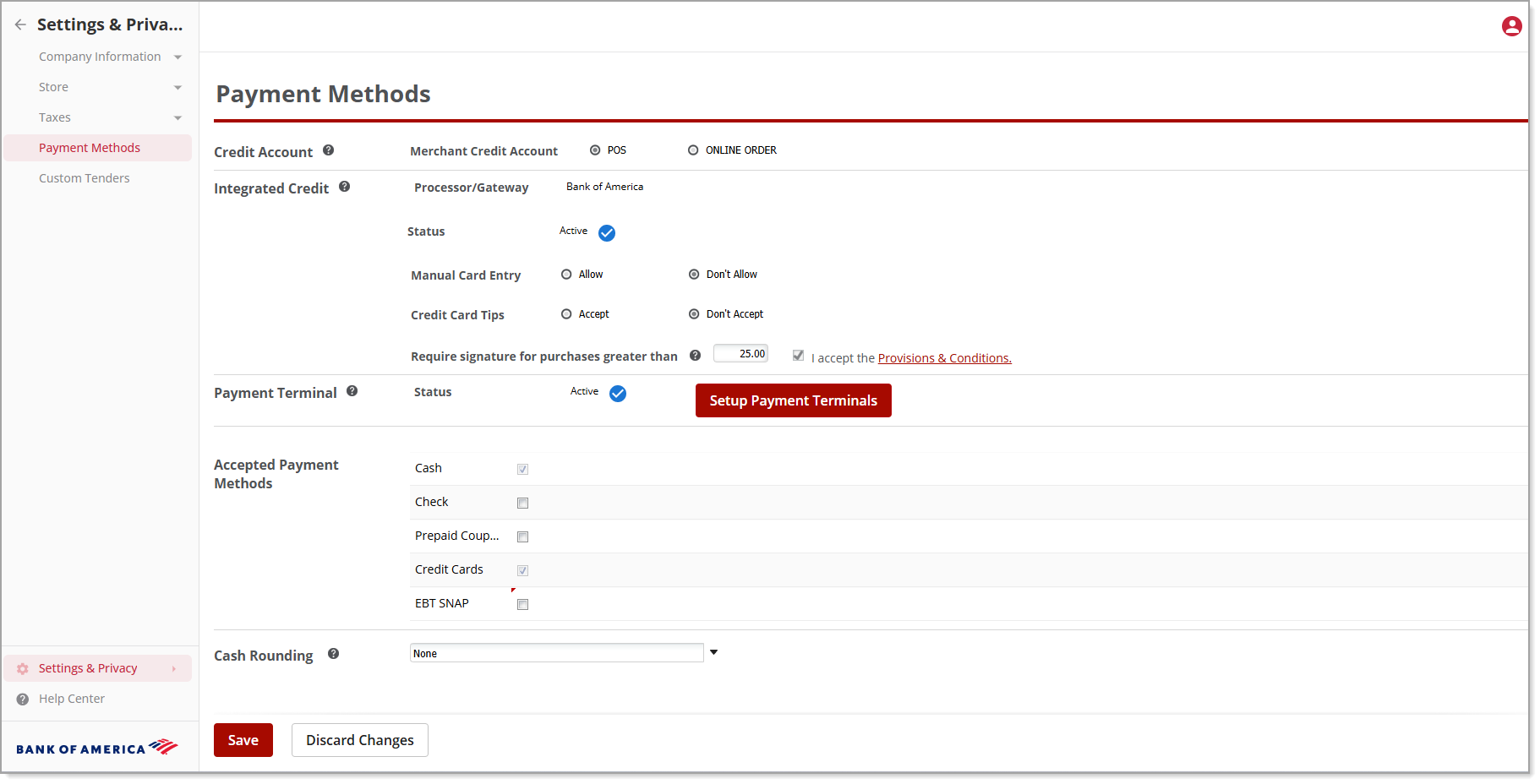

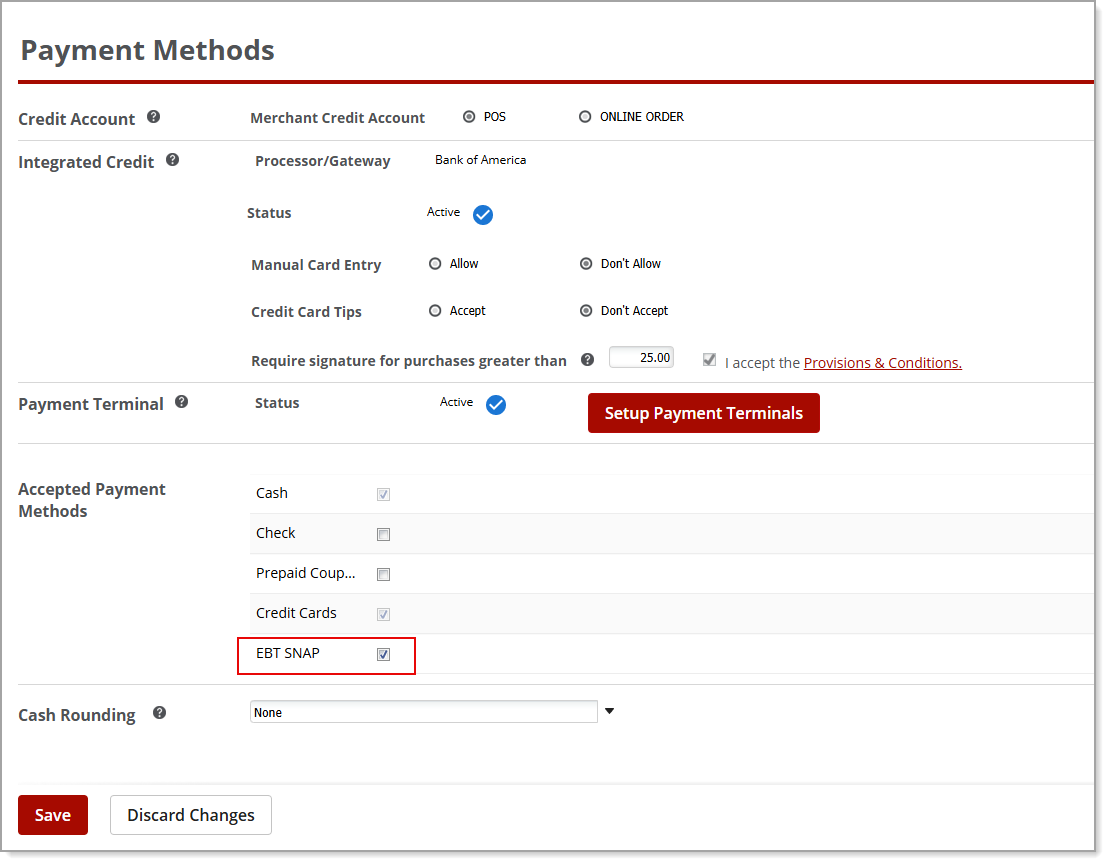

1. In the Back Office click Settings & Privacy in the lower right corner.

2. From the left navigation, select Payment Methods.

3. Under Accepted Payment Methods, select the EBT SNAP checkbox.

5. Click Save.

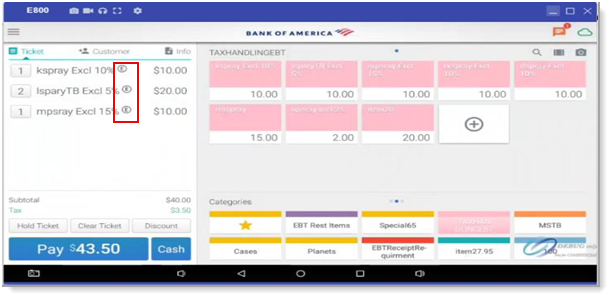

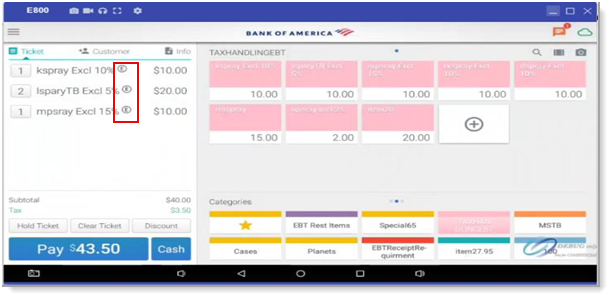

EBT items in Retail app

On the point of sale, an item applicable for EBT will have an “E” symbol next to their item name when selected during the transaction. Items that are not EBT-eligible should be restricted based on the Back Office tag and restrictions that have been set for the item(s). Only EBT items may be selected to pay with an EBT card.

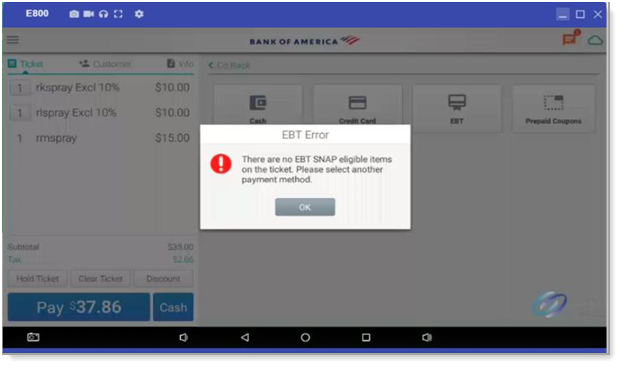

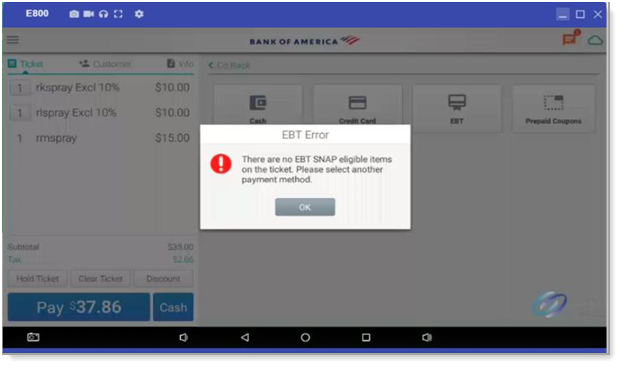

EBT error

If there are no EBT-eligible items in a transaction and EBT is selected as a payment method, an error will appear indicating there are no EBT SNAP eligible items on the ticket and EBT payment method is not applicable.

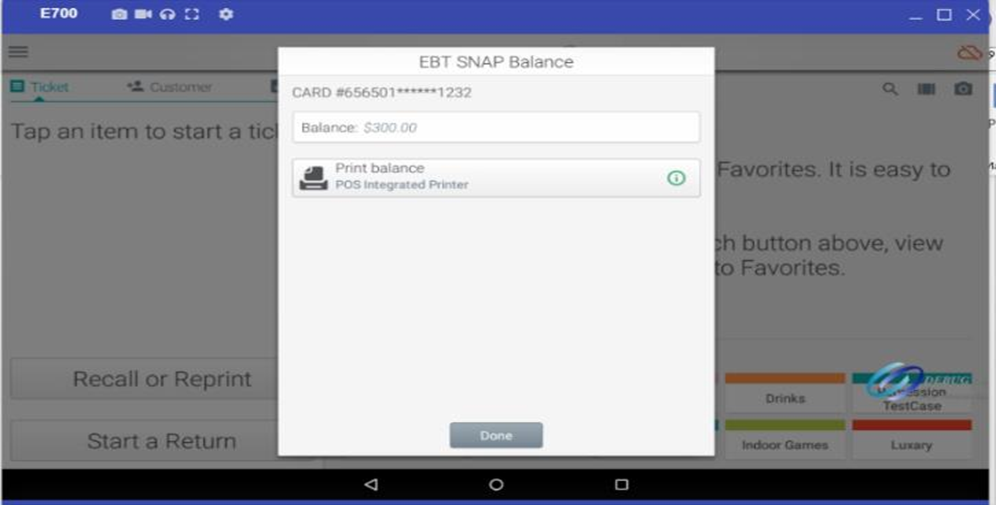

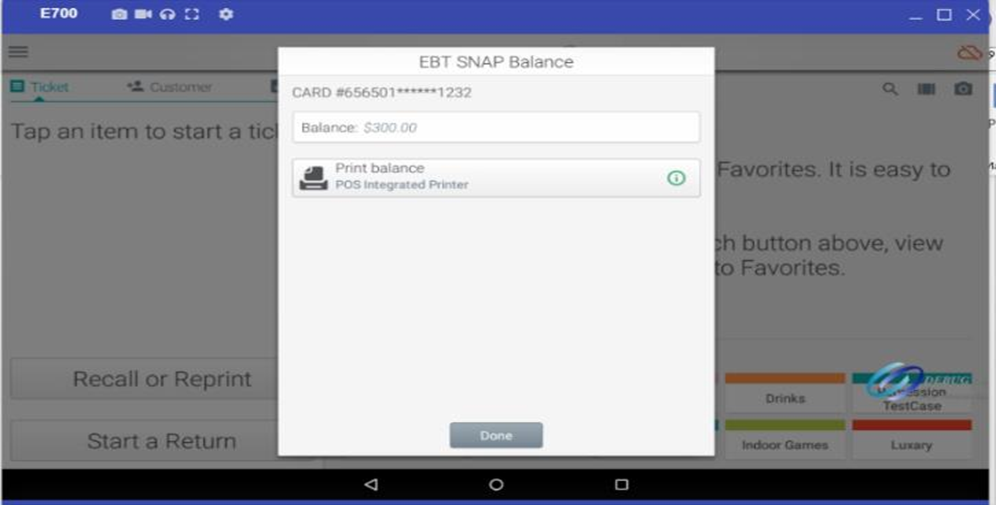

EBT card balance inquiry

You can perform an EBT card balance inquiry prior to accepting EBT as a form of payment at the point of sale. If you don’t see the option to check EBT SNAP Balance, please check with your manager to review your user role permissions and system access.

- Point of Sale Solution App

- Under Lookup, click on EBT SNAP Balance.

- Follow prompts to swipe the EBT card.

- From the EBT SNAP Balance prompt, click Print balance to print or click Done to close the popup window.

EBT card acceptance guidelines

Below are some quick EBT guidelines for Retail Solution. You can find additional information about eligibility, registration and rules at: USDA SNAP Retailer.

- Sales tax should not be charged on EBT SNAP eligible items (inclusive or exclusive).

- You can only forgive tax on the portion that is purchased with EBT SNAP. If the balance remaining on the EBT SNAP card does not cover the EBT SNAP-eligible items, another MOP must be used.

- Sales tax must be charged for items purchases using an alternate payment method therefore tax must be recalculated on the remaining balance due.

- The highest tax price item will be considered first for EBT partial payment transactions to benefit the customers. (Ex: if customer purchased 50% tax item with price $100 and 25% tax item with $200, in case of EBT partial payment 50% tax item will be considered to get maximum benefit for the customers.

- EBT SNAP card should be processed before any other payment methods (Ex: If customer is purchasing EBT-eligible and restricted items then the EBT payment for EBT-eligible items should be processed first. A second transaction using another payment method should be used for the restricted items).

- The EBT payment method cannot be processed if the customer is attempting to purchase only EBT restricted items. Another form of payment must be used.

- Multiple EBT payments on a single ticket are not supported.

- The split payment button will be disabled for EBT payments.

- If there is a tax override on ticket, it will be removed once EBT is selected as the method of payment.

When the tag is selected, the Save button becomes enabled.

When the tag is selected, the Save button becomes enabled.