Point of Sale Solution Back Office Taxes Report

Description

How to download a summary of tax collected

What's in this article?

Software Plan: Basics | Starter | Growth | Pro

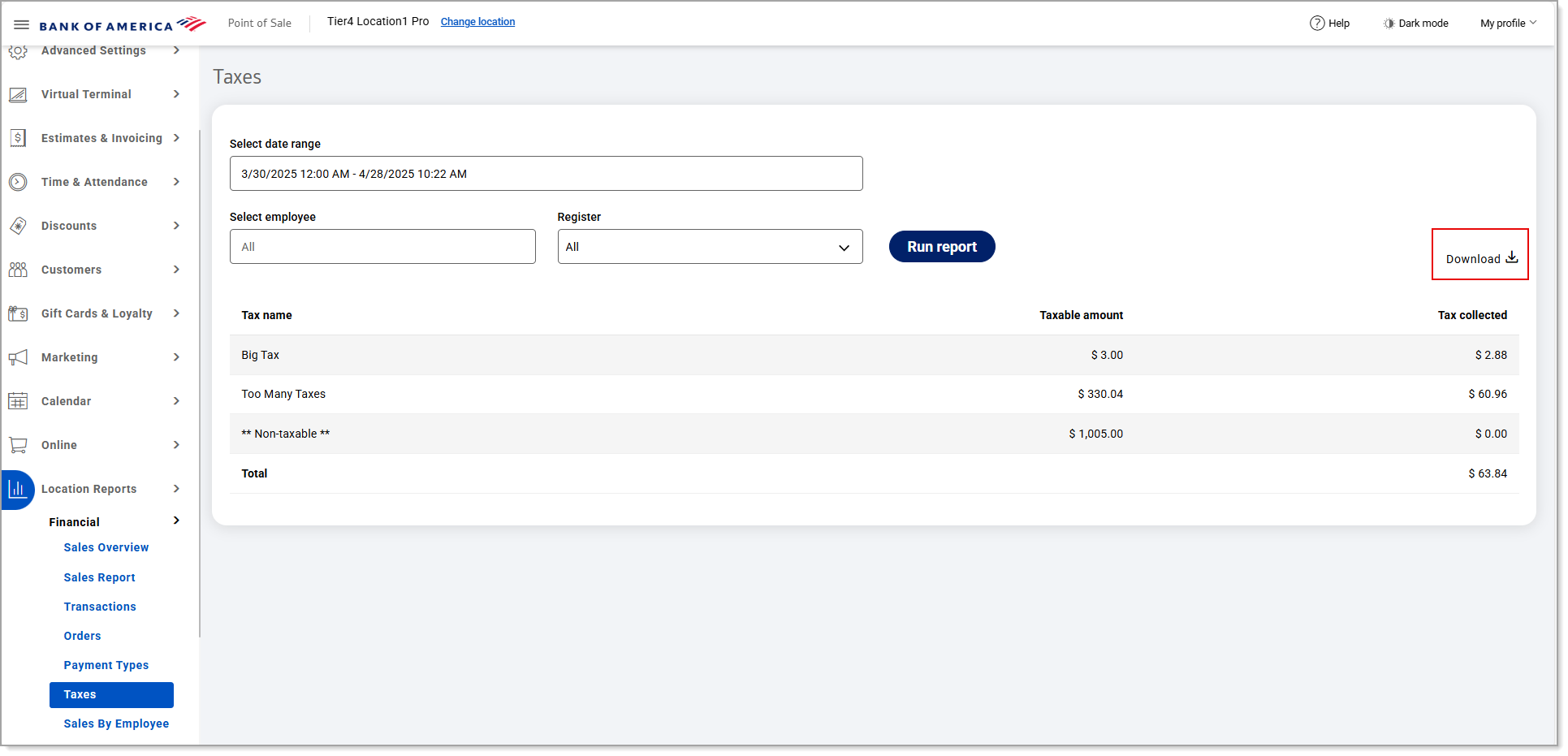

The Taxes report provides a view of tax information for sales transactions that have taken place within a specified time period. You can search for tax information using default date ranges or custom date ranges with no maximum time span. Reports can be downloaded and saved in Excel format.

To run the Taxes report

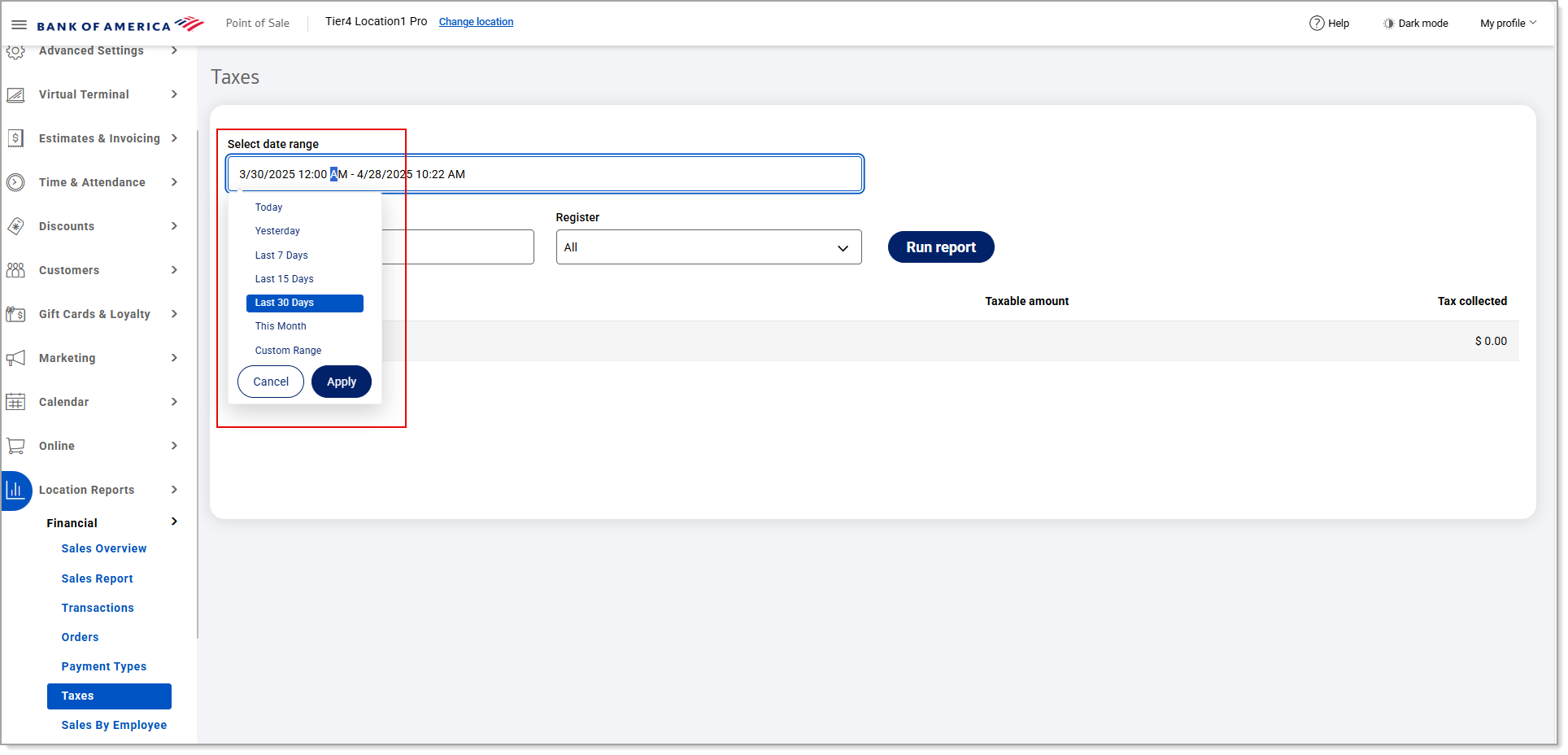

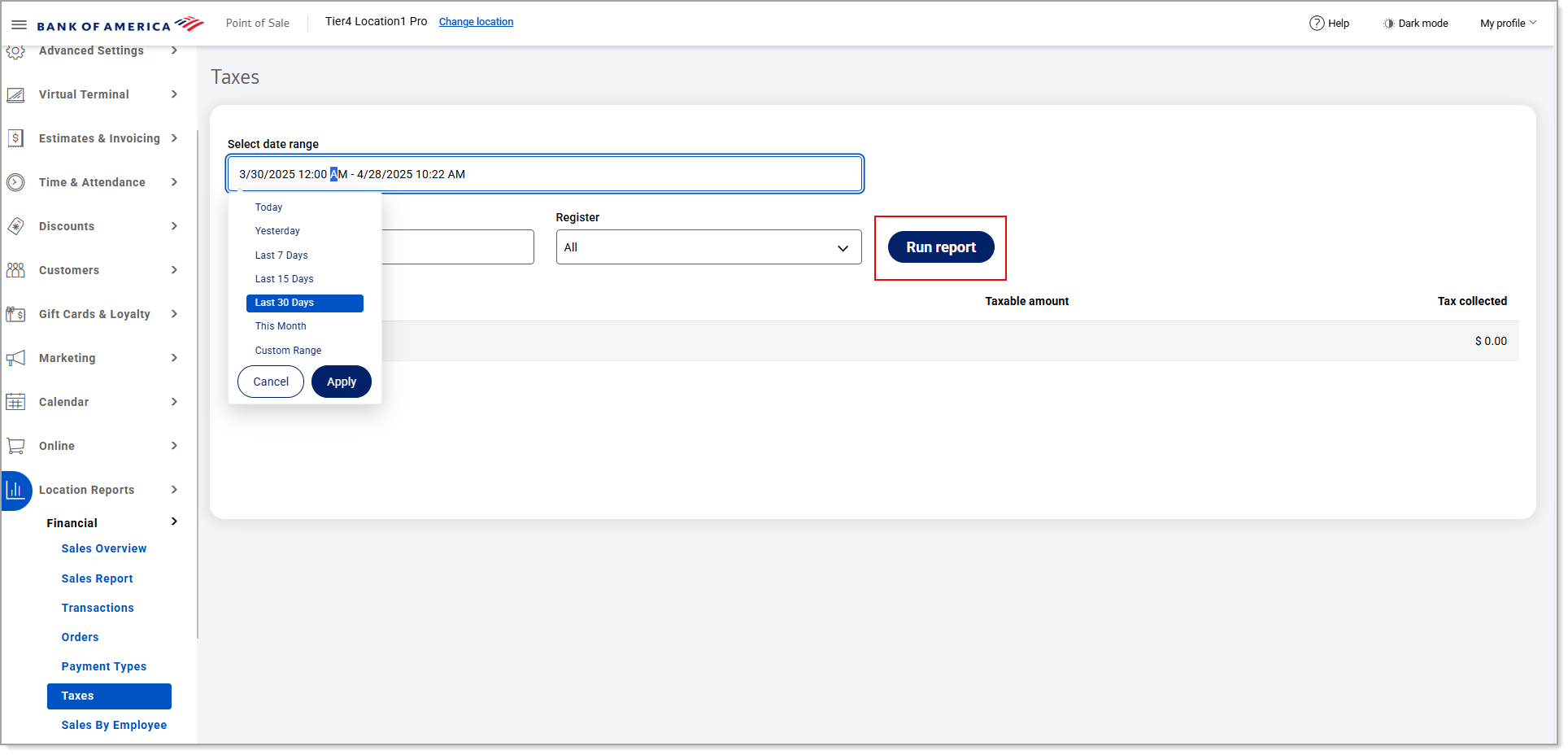

- In the Point of Sale Solution Back Office, select Location Reports > Financial > Taxes.

- Select a preset range from the dropdown list or select Custom Range to specify exact dates and times. Click Apply.

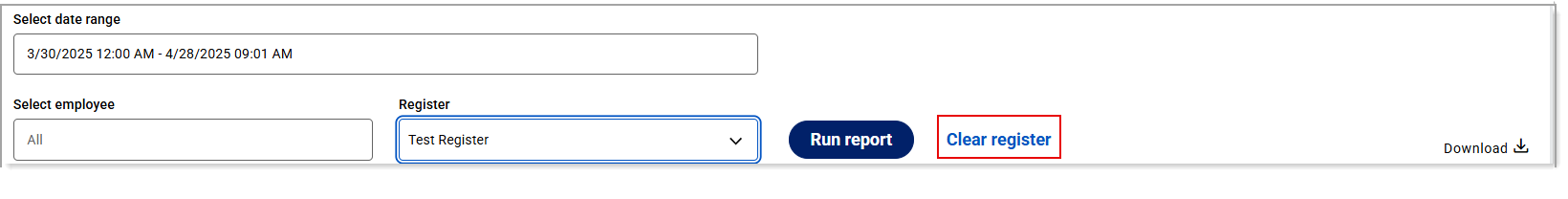

If you need a summary of tax information for a single employee, begin typing the employee name in the Select employee field and select the name from the dropdown list. If you need transaction information for a single register, select the register from the Register dropdown list. Otherwise, tax information for transactions under all employees and all registers will display for the specified date range.

If you need a summary of tax information for a single employee, begin typing the employee name in the Select employee field and select the name from the dropdown list. If you need transaction information for a single register, select the register from the Register dropdown list. Otherwise, tax information for transactions under all employees and all registers will display for the specified date range.NOTE: After selecting a specific register, the Clear Register option appears. Use this option to clear the selection in the Register field, if needed.

- Click Run report.

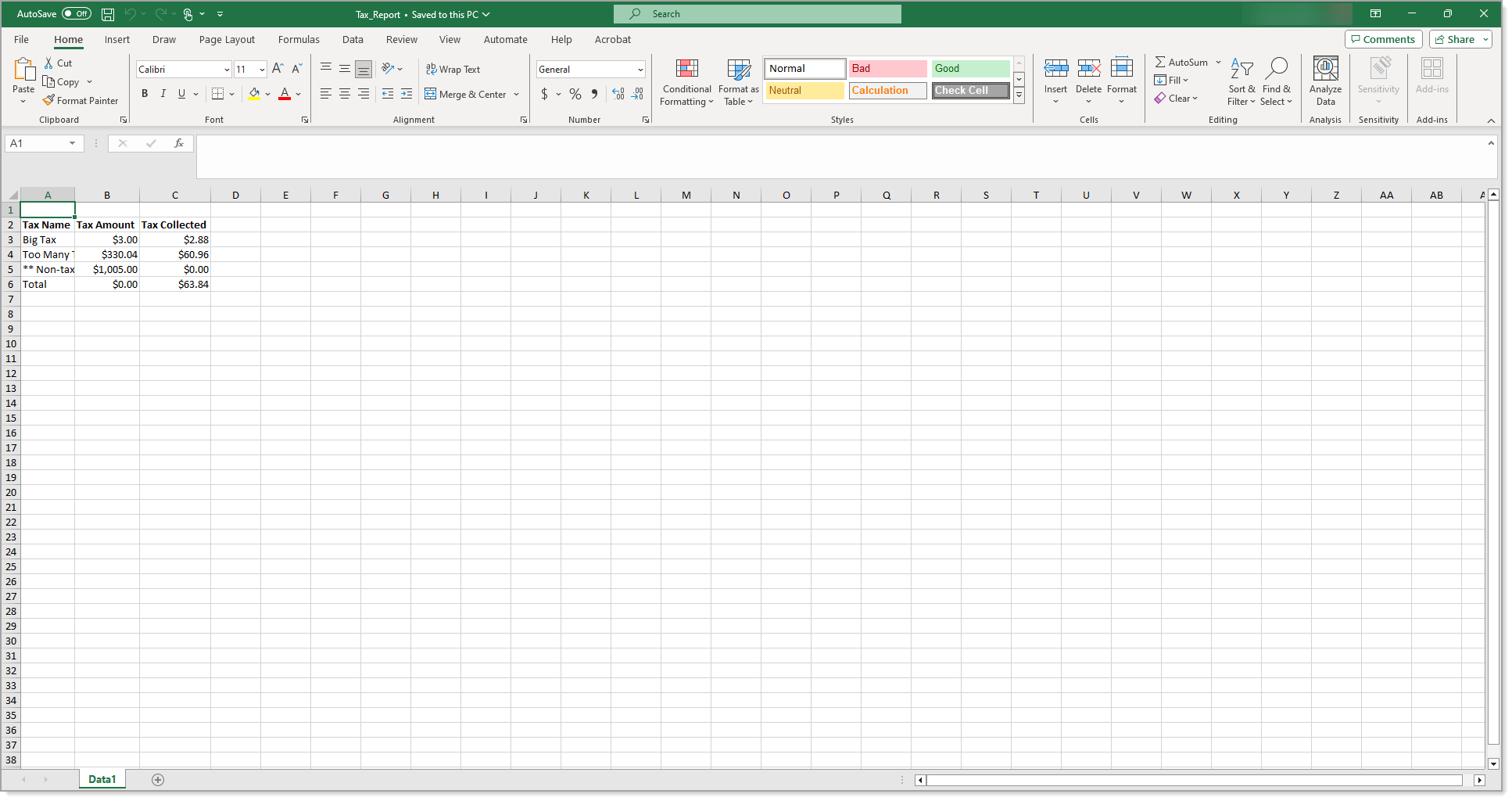

- Click Download to download the report in Excel format.

The report will display the following:

Field | Description |

|---|---|

Tax name | The name of the specified tax (e.g., State Tax, Sales Tax, Toll Tax). |

Taxable amount | The taxable amount for all sales. |

Tax collected | The total amount of each specified tax collected. |