Merchant Services Account Client Information

Description

What's in this article?

Use Client Information to view quick reference information for your merchant account. Locations includes the location details of the client such as the address. Client Details includes your merchant name, client number, contact information, addresses, etc. Services includes the card scheme and non-card scheme services that are assigned to the client. Client Commission includes all the charges to transactions the client may incur on a transaction-by-transaction basis. Account Fees includes all the fees charged to the client based on the merchant accounts. Service Fees includes the fees charged based on a set of services that will be assigned to the client.

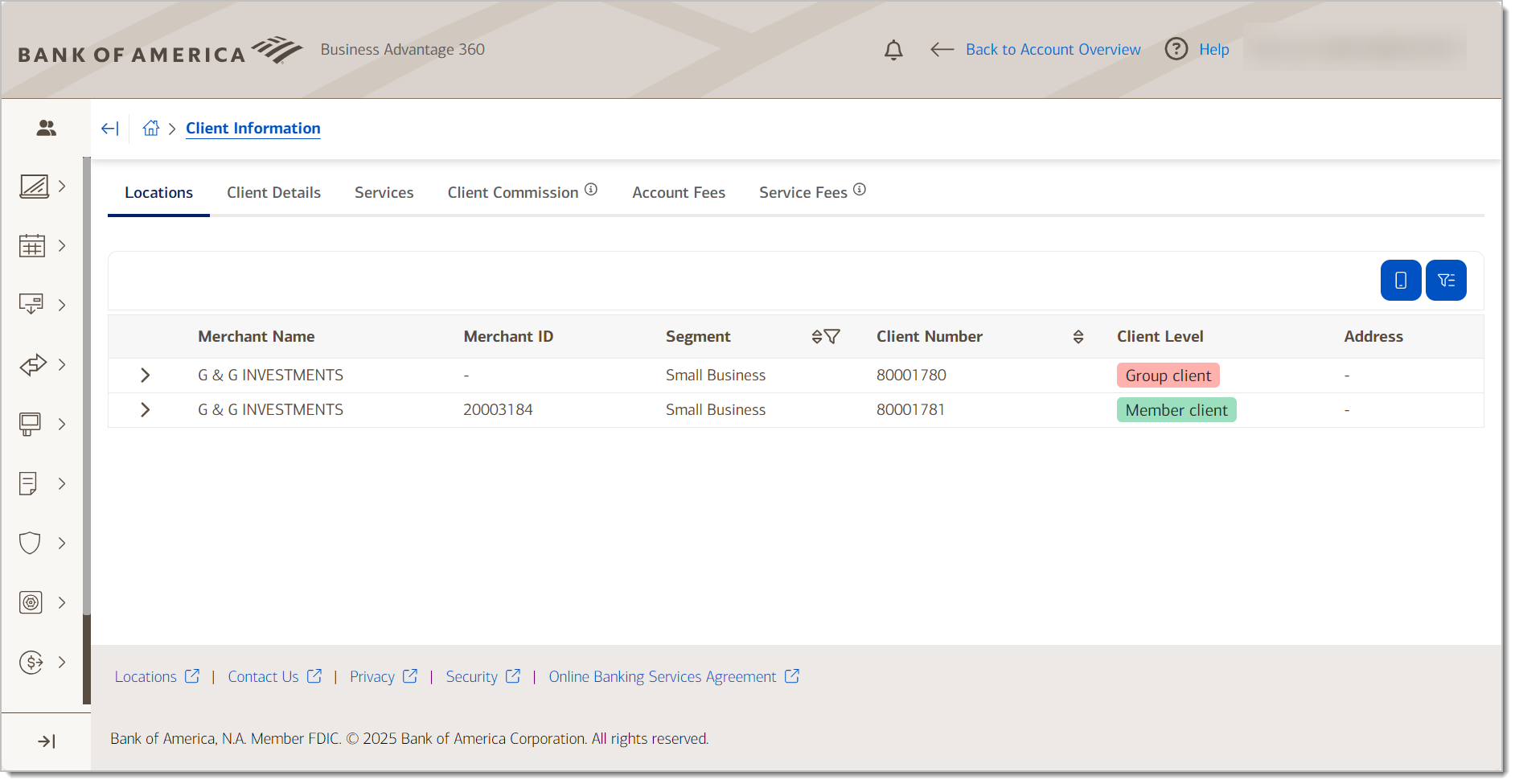

Locations

View location details, including the Merchant Name associated with the location, the Merchant ID number, the banking segment, the client number for the account, the location level (whether it is the main relationship or a member of the relationship), and the location address.

- Group client is the relationship-level merchant account

- Member client is a location for the relationship

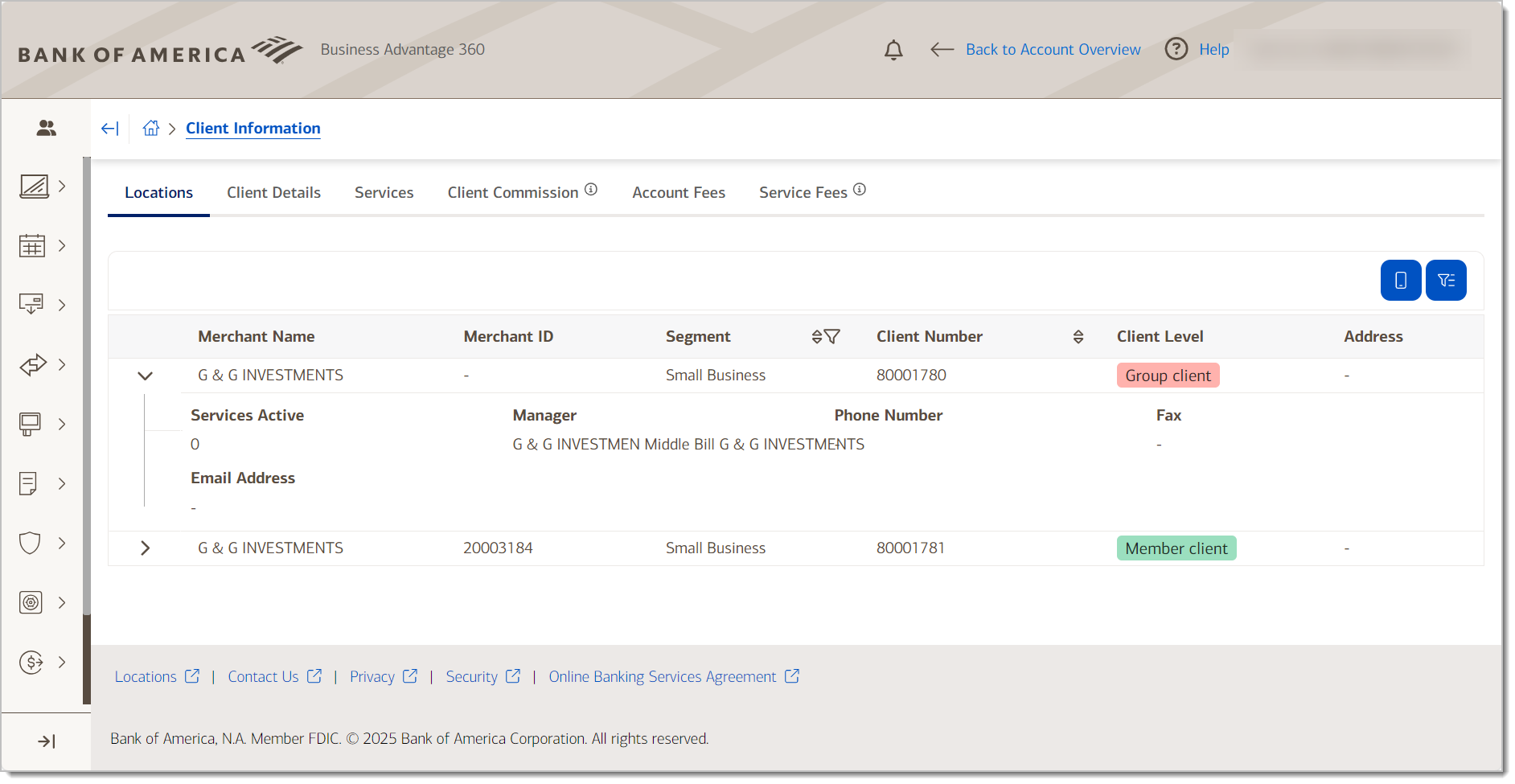

You can view more specific details for the account, such as number of active services associated with the account, the account manager, and contact information on file.

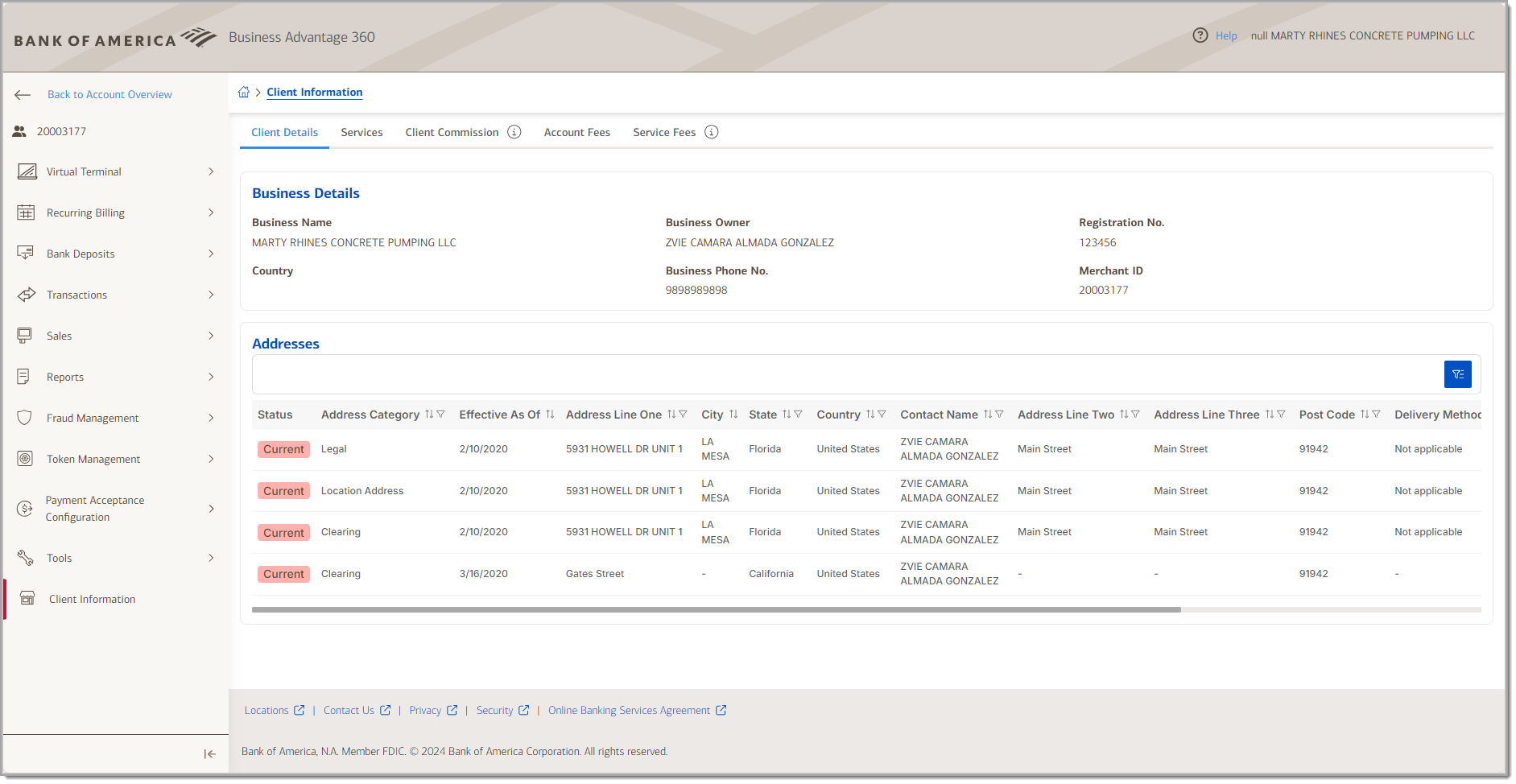

Client Details

Review your business details, including your Merchant ID number and the contact information associated with our account. You can filter the address list if desired by clicking the Filter button at the top right of the Addresses box. The addresses listed indicate whether the address is current and when the address became or will become effective. Scroll to the right to view additional fields, including the email address associated with the location.

NOTE:

Registration No. is an unused field.

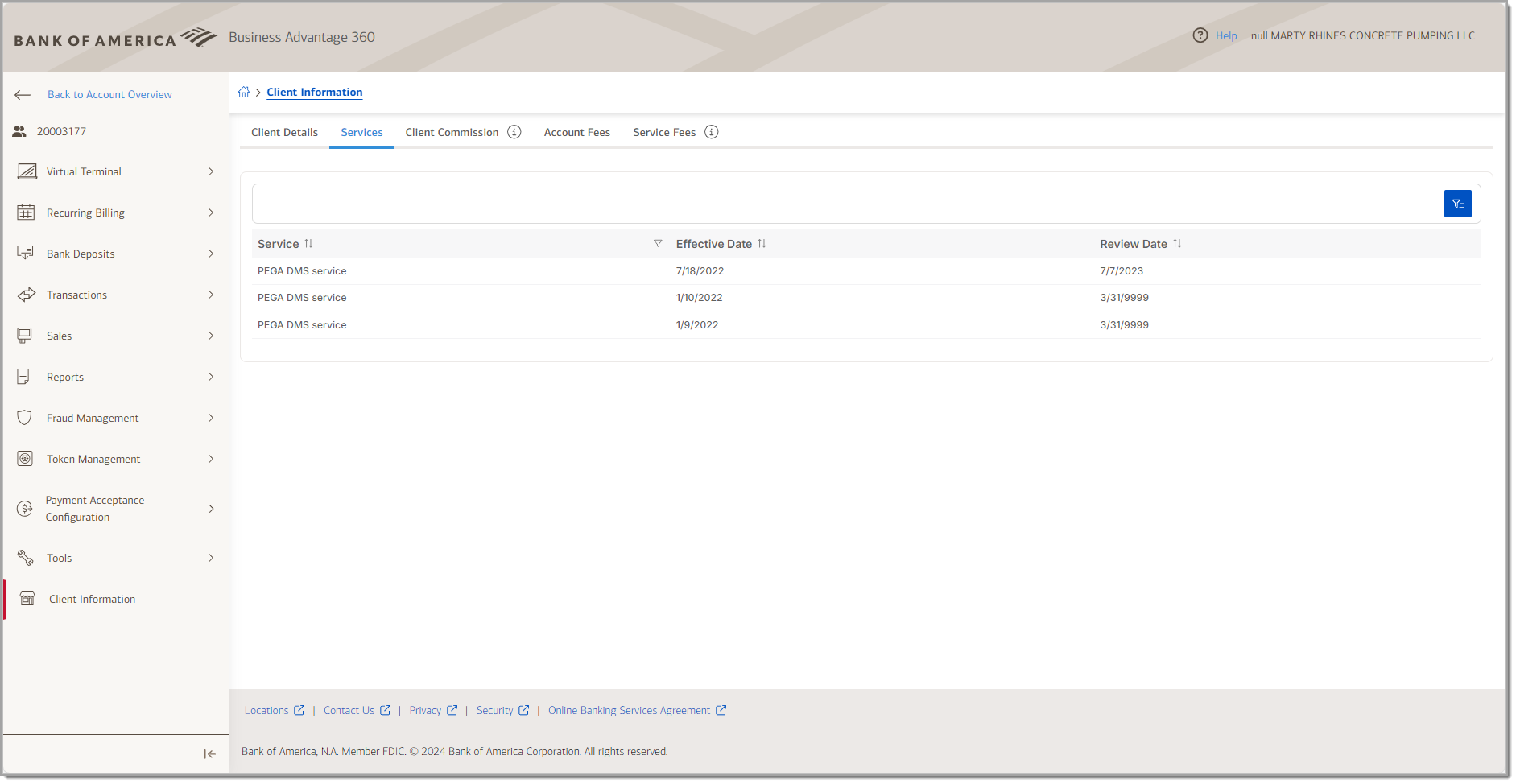

Services

Card scheme and non-card scheme services assigned to the account.

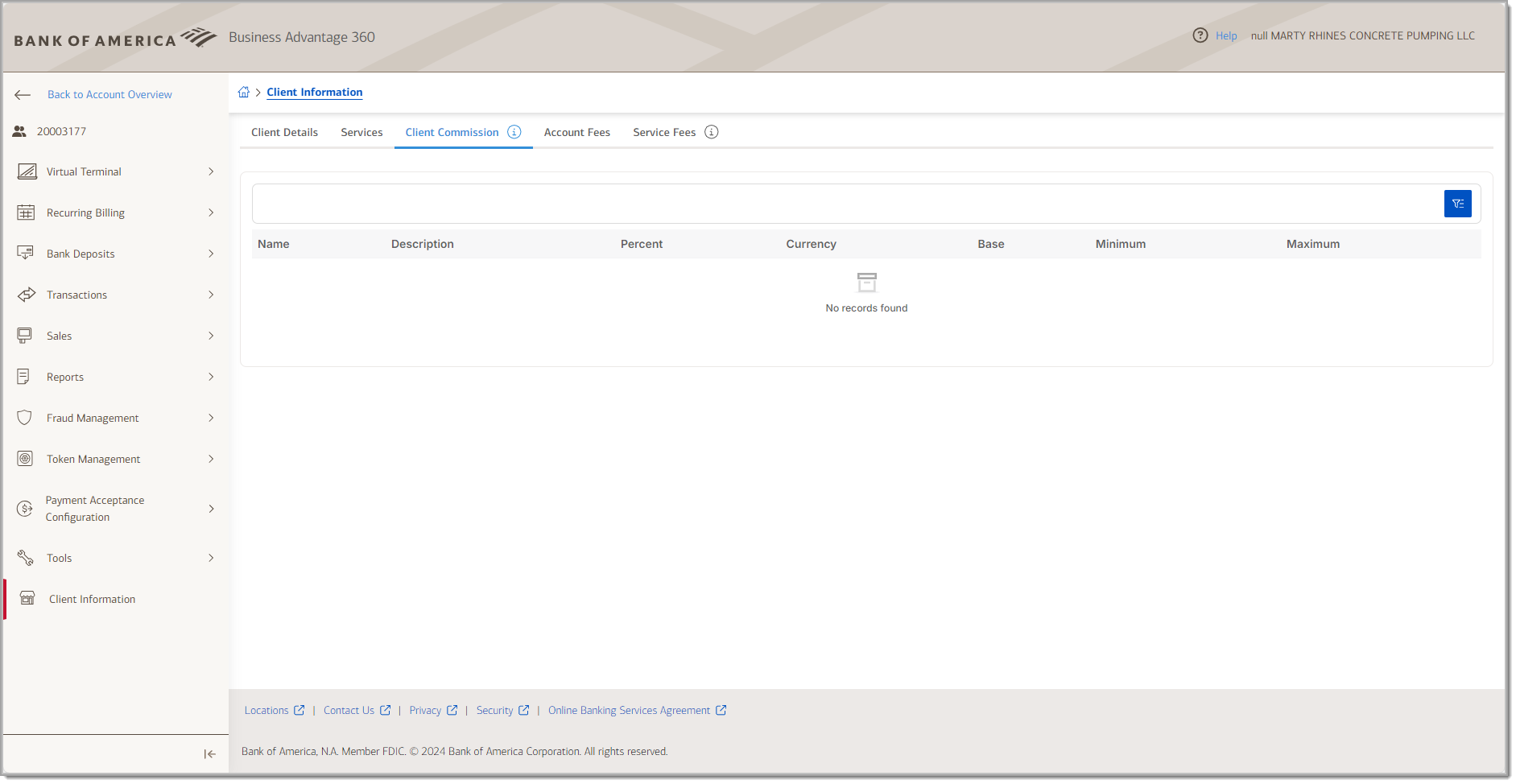

Client Commission

Displays all the transaction charges that your account may incur on a transaction-by-transaction basis.

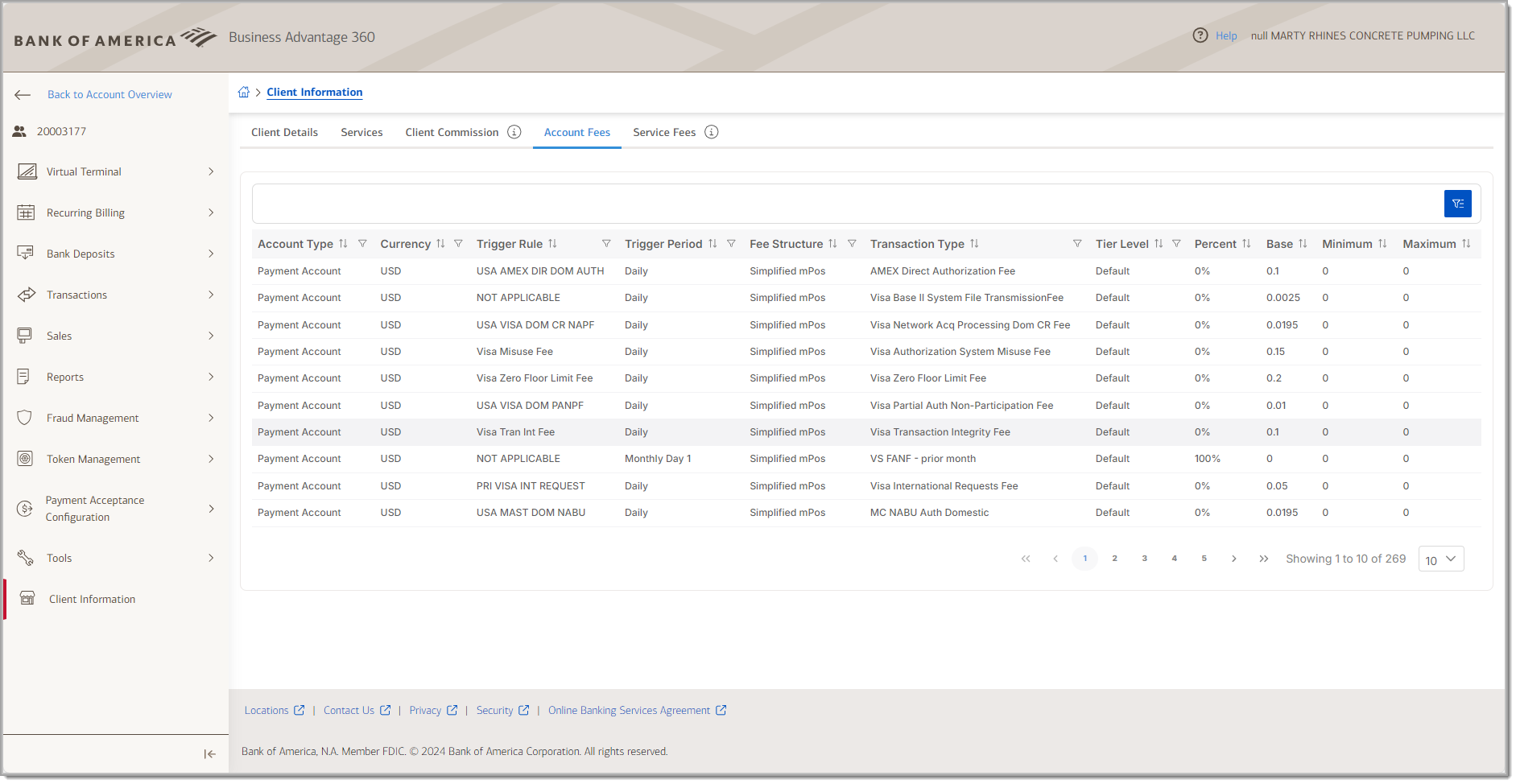

Account Fees

Account Fees displays the fees associated with transactions on the account, including chargeback fees. You can view the Account Fees as a scrollable table or click the Toggle Scrollable Columns icon to switch to a non-scrolling view.

| Field | Description |

|---|---|

| Account Type | Payment Account |

| Currency | USD |

| Trigger Rule | Rule that triggers the fee |

| Trigger Period | Defines when the fee is generated |

| Fee Structure | Assigned fee |

| Transaction Type | Fee generated based on the original transaction: authorization fee, chargeback fee, etc. |

| Tier Level | Tier level of the fee |

| Percent | Fee percent charged of the original transaction |

| Base | Base amount of the fee charged, regardless of the original transaction amount or without a present transaction |

| Minimum | Minimum amount of fee charged |

| Maximum | Maximum amount of fee charged |

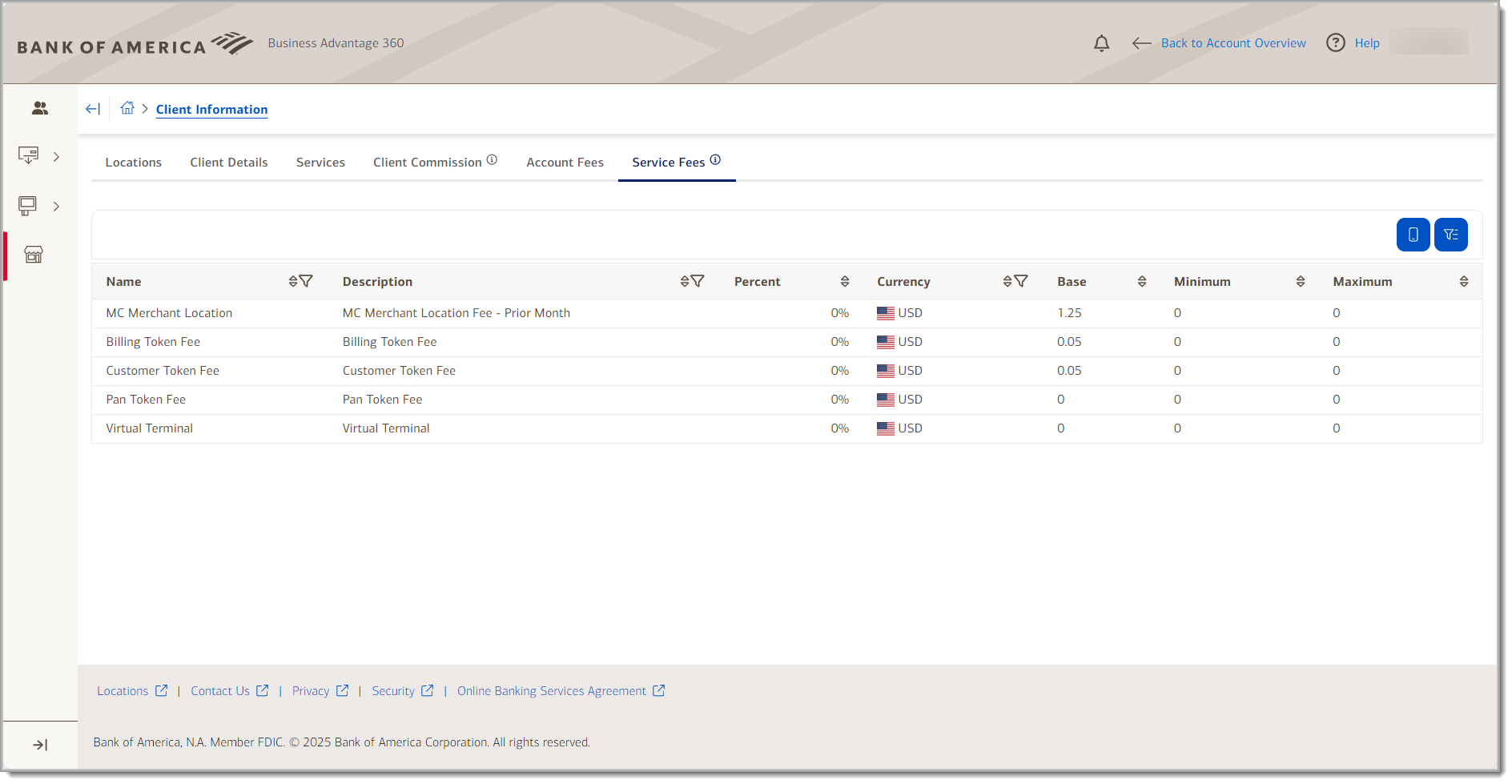

Service Fees

Service Fees displays the fees for additional account services, such as Recurring Billing, that the location is signed up for.

| Field | Description |

|---|---|

| Name | The name of the service fee |

| Description | The fee description |

| Percent | The percentage charged per transaction for that fee |

| Currency | The currency in which the fee is charged |

| Base | The base charged per transaction for that fee |

| Minimum | The minimum amount that is allowed to be applied as a fee |

| Maximum | The maximum amount that is allowed to be applied as a fee |