Point of Sale Solution Back Office Fraud Management

Description

What's in this article?

Fraud Management is a powerful fraud-prevention solution for small to mid-market businesses that evaluates card not present transaction data. In addition to using transaction data to generate a machine-learning fraud risk score, the platform operates via business rules and a reference list.

Enabled with an active set of pre-configured rules, settings and model score thresholds, outcomes are generated based on your fraud business strategy. Rules may be used to accept transactions, pend a transaction for review, reject transactions, as well as monitor or force accept the transaction.

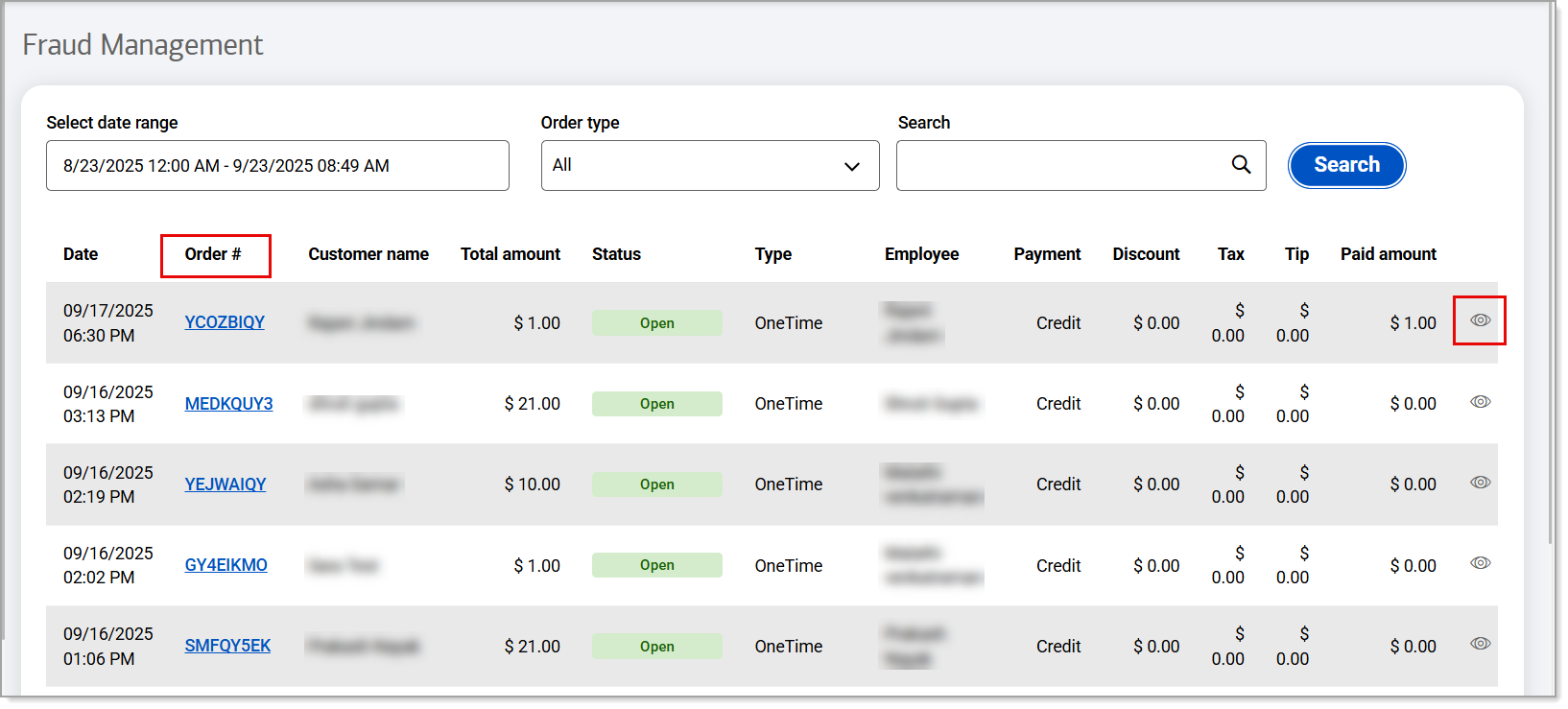

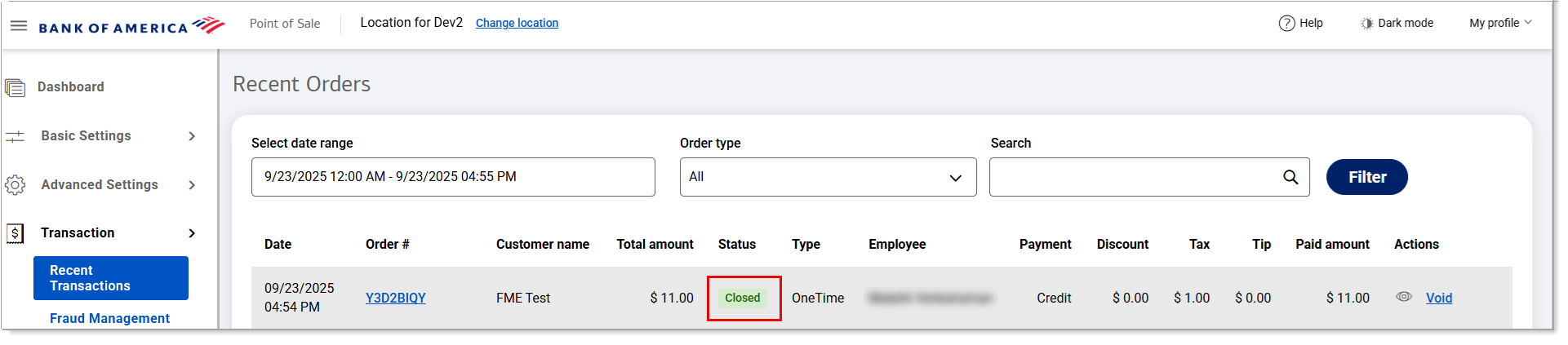

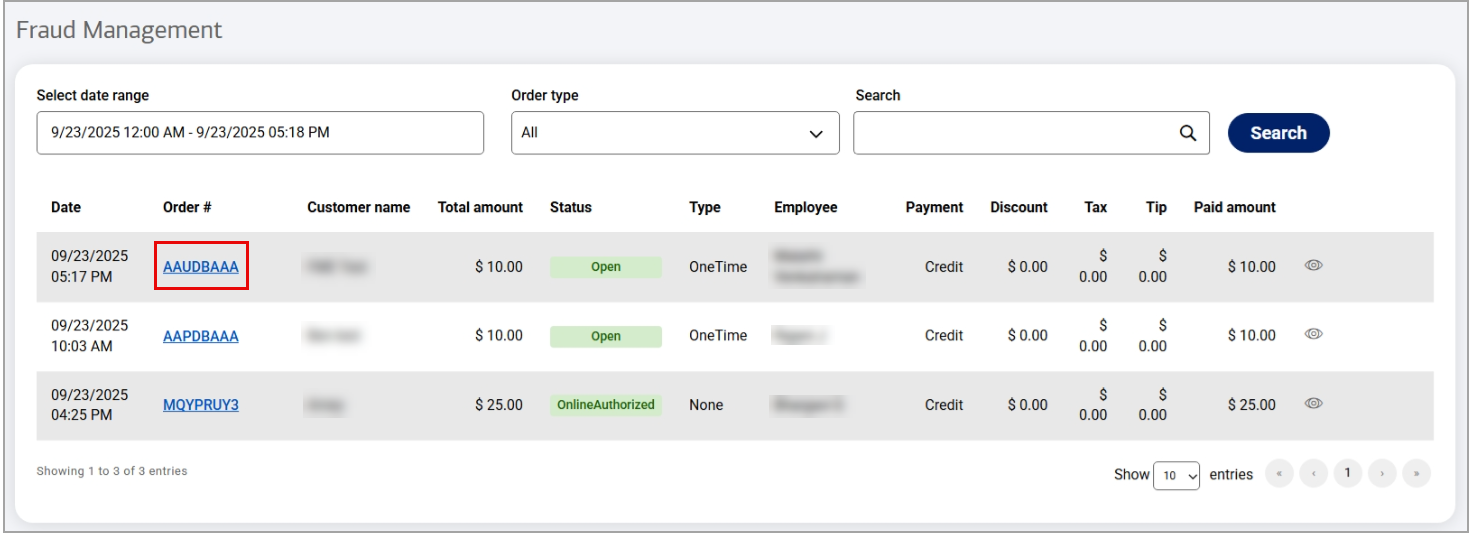

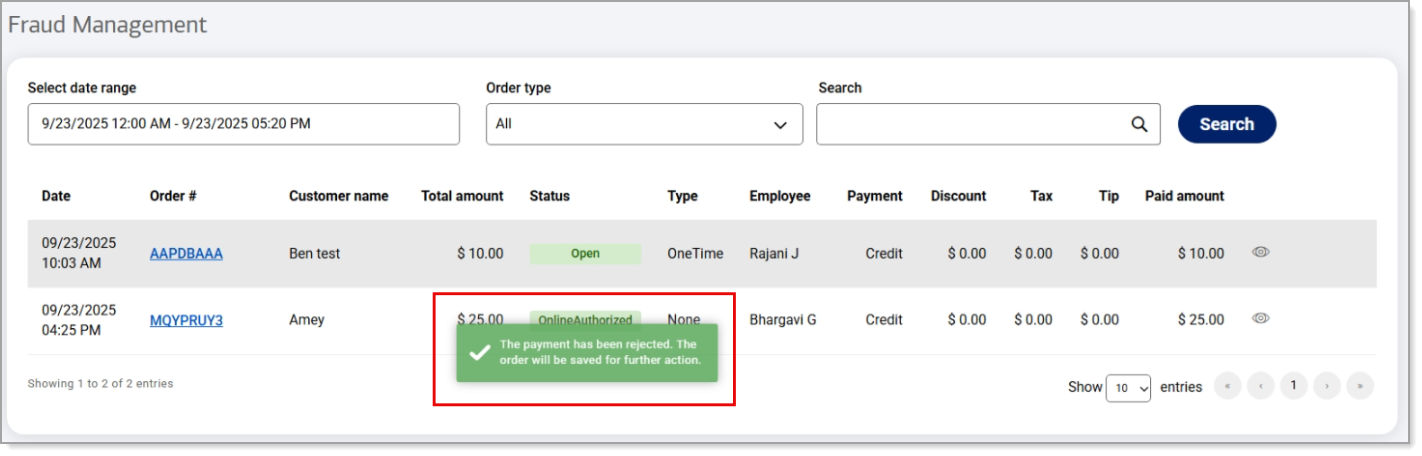

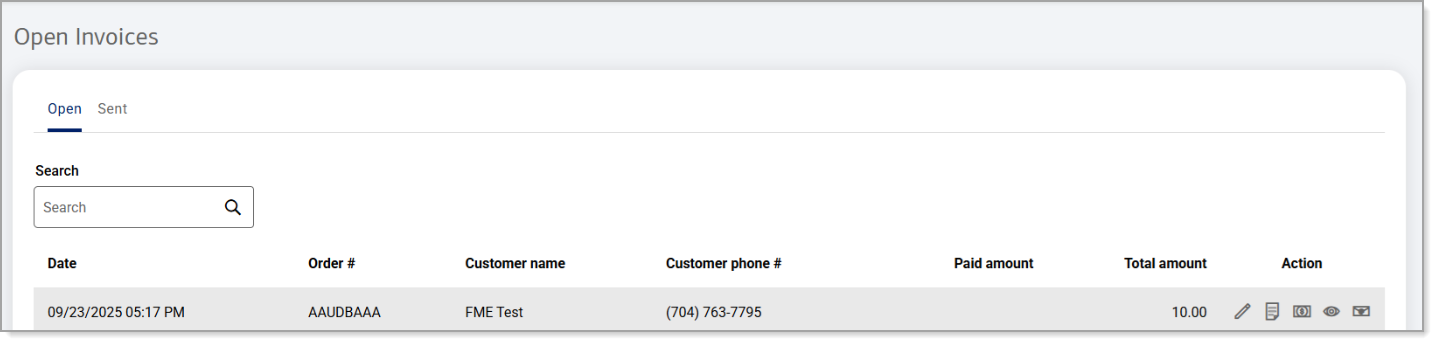

Any order flagged by fraud management rules will not appear in the Recent Orders screen in the Back Office, but will appear on the Fraud Management screen. Check the Fraud Management screen to view flagged transactions and accept or reject them.

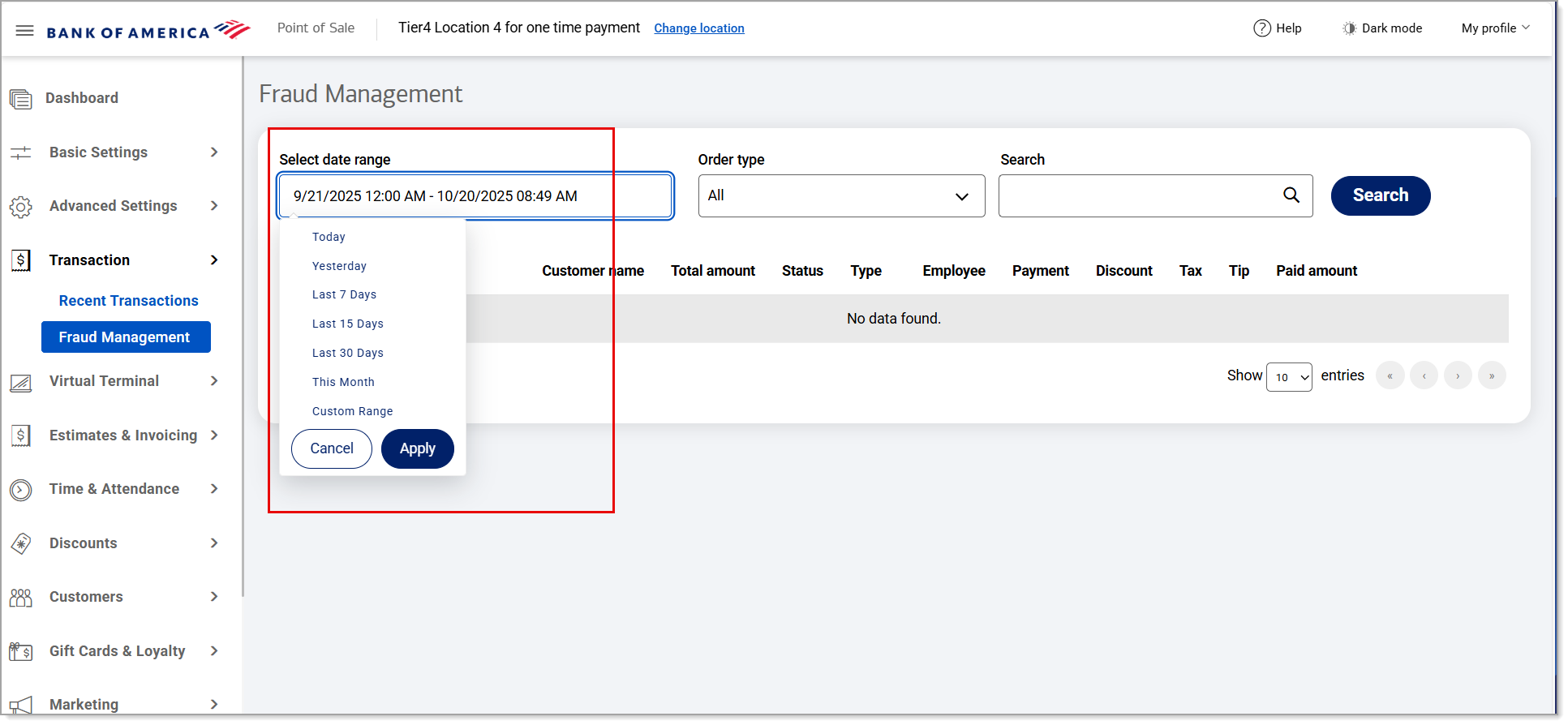

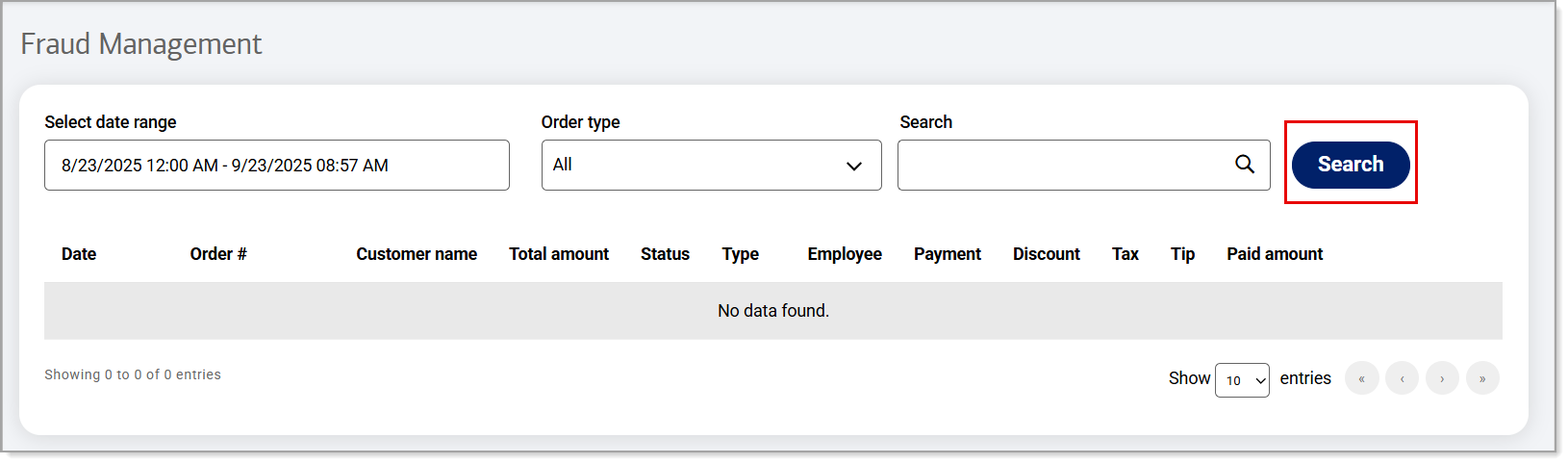

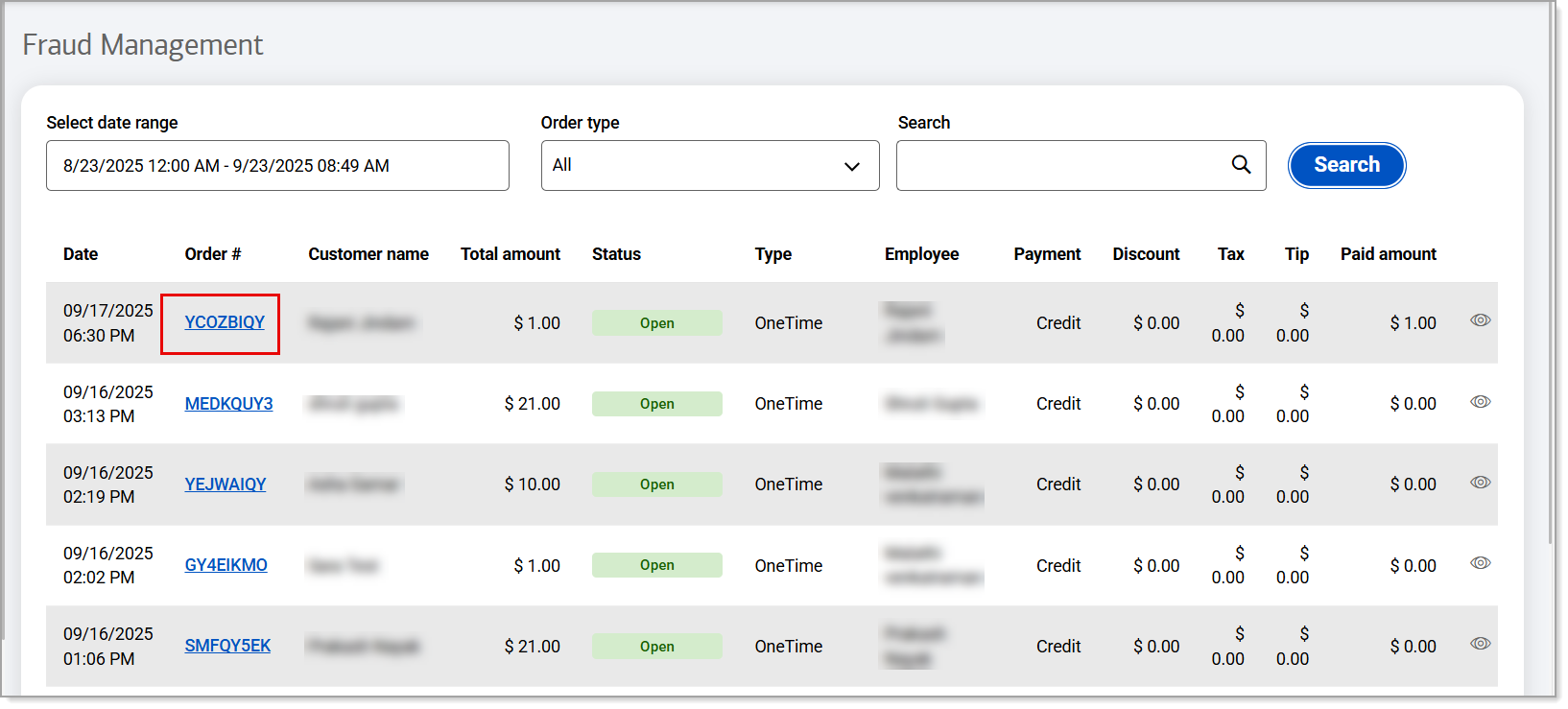

View flagged transactions

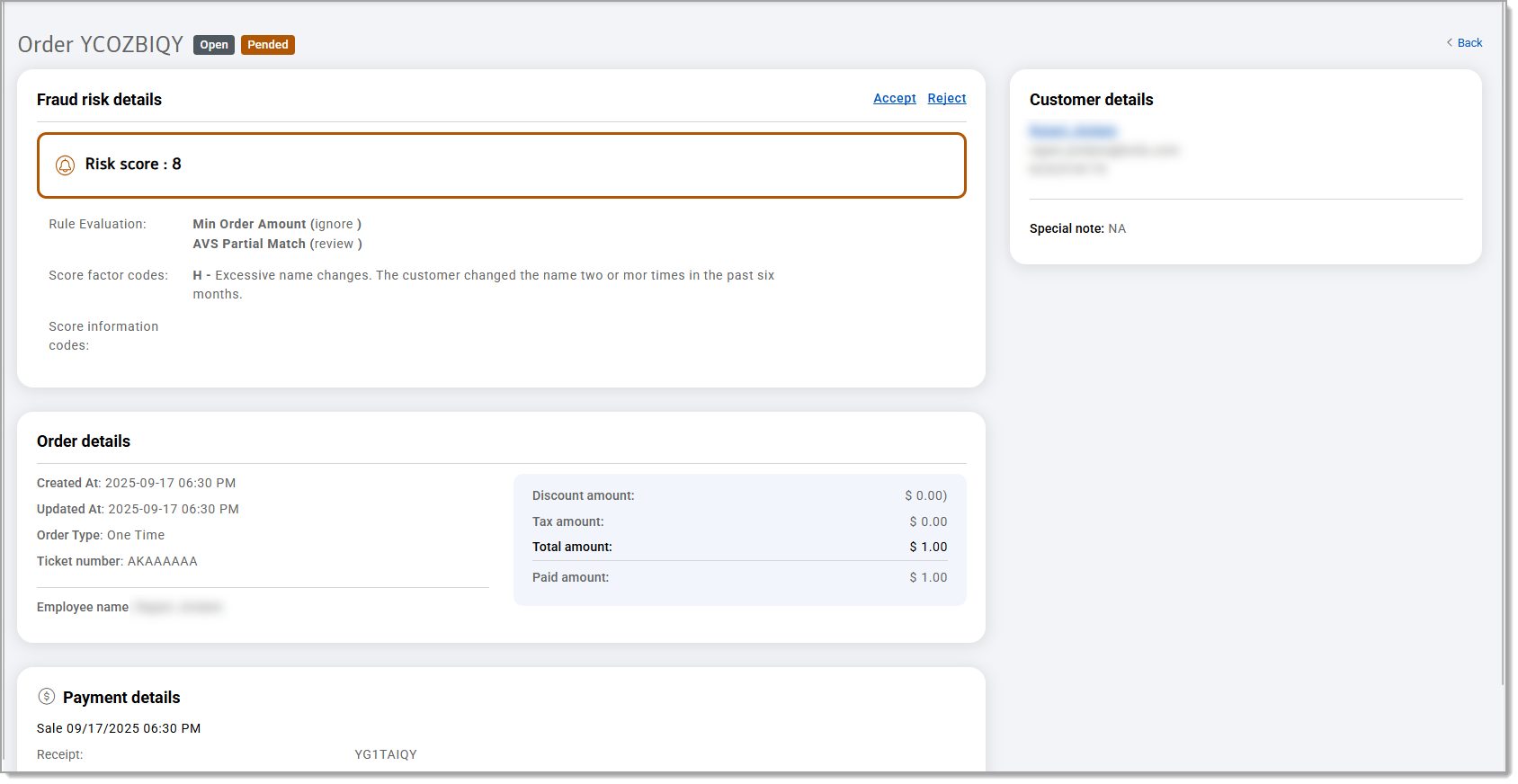

On the Fraud Management screen in the Back Office you can view the reasons why a transaction has been flagged.

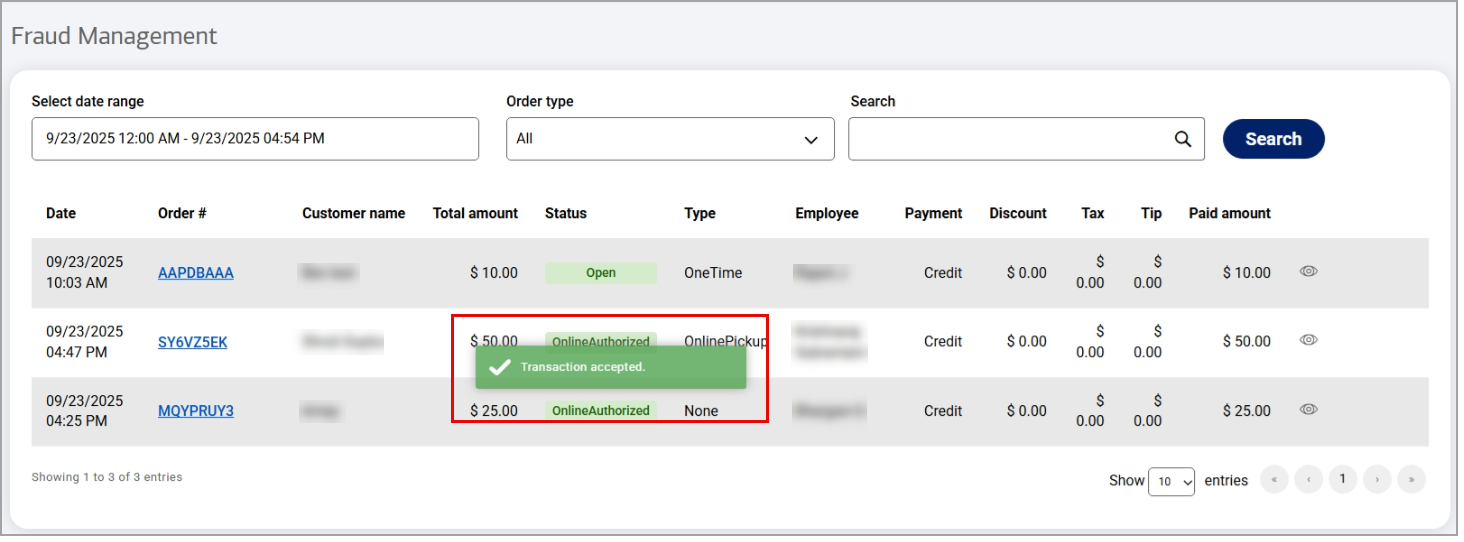

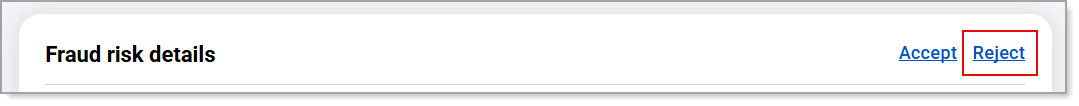

Accept or reject transactions

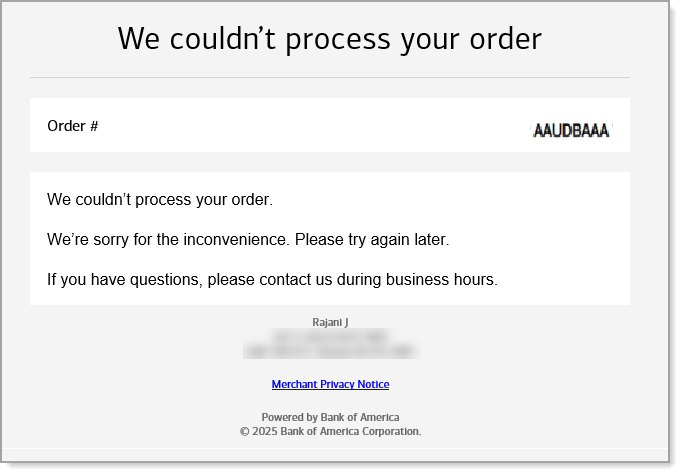

When an order is received, the customer receives a notification that the order is being processed.

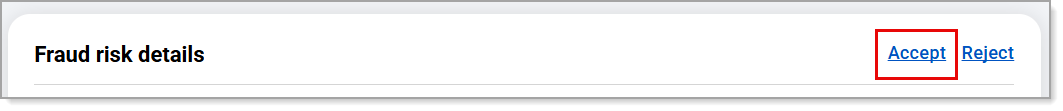

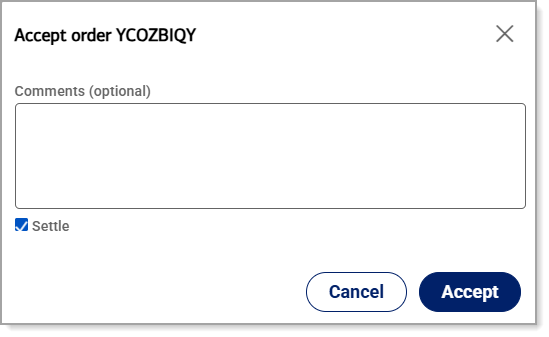

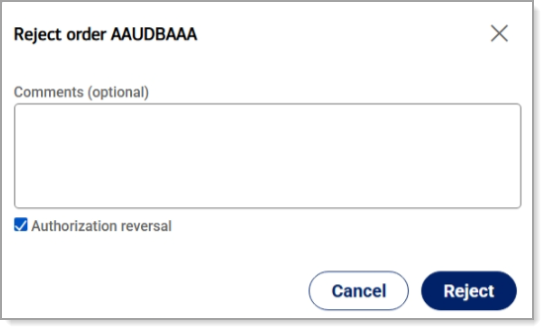

After reviewing the fraud risk details of a flagged transaction, you can decide to accept or reject it.