Merchant Services Account Recurring Billing Transactions

November 17, 2025

Description

How to view, void, or refund a Recurring Billing transaction in your Merchant Services account in online banking

In your Merchant Services account in online banking, you can view details related to your Recurring Billing transactions and void or credit (refund) a Recurring Billing transaction.

NOTE:

If you use the Point of Sale Solution, your Recurring Billing transactions are managed from your Point of Sale Back Office.

View recurring transactions

When you set up a customer with a recurring subscription and plan, the transaction occurs according to the plan schedule.

- To view a recurring transaction

- Log in to your Merchant Services account in Business Advantage 360 online banking.

- Select Transactions > Transaction List. The Transaction List page appears, showing all transactions performed in the past 7 days.

- If needed, filter the date to find the transaction. You can view up to the last 6 months of transactions.

- Locate the transaction that you would like to review and select the hyperlink in the Request ID column. The Transaction Details page displays.

- Review the transaction.

Refund a recurring transaction

Within 60 days of a transaction, you can credit the full or partial amount of the original transaction.

IMPORTANT!

A credit cannot be completed after 60 days. Credit refunds should never be completed by providing cash back to the cardholder.

- To refund a recurring transaction

- Log in to your Merchant Services account in Business Advantage 360 online banking.

- From the left navigation, select Transactions > Transaction List. The Transaction List appears, showing all transactions performed in the past seven days.

- Click the Date Range filter to change this range as needed. You can view up to the last six months of transactions.

- Locate the transaction that you would like to review and select Request ID link.

- Review the transaction details to ensure that the correct transaction has been selected.

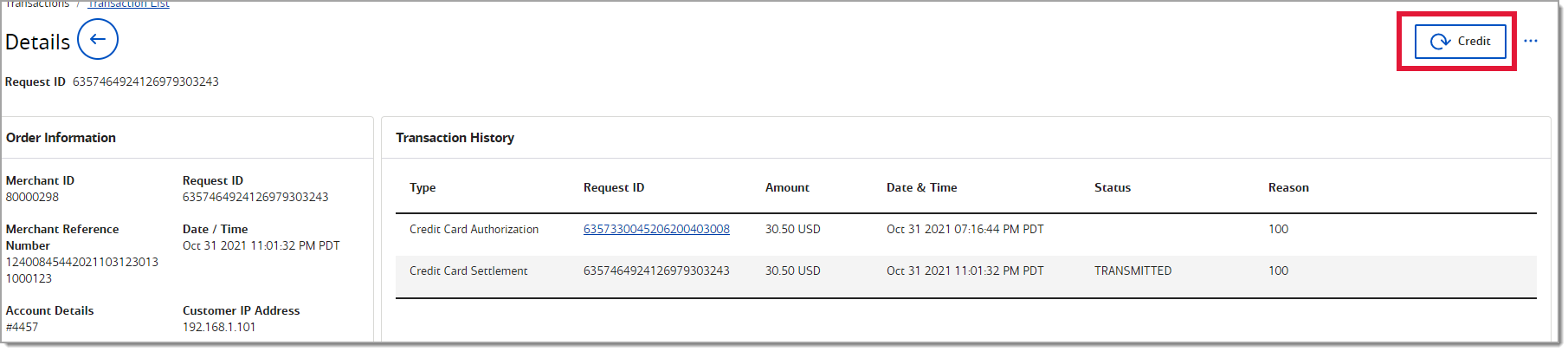

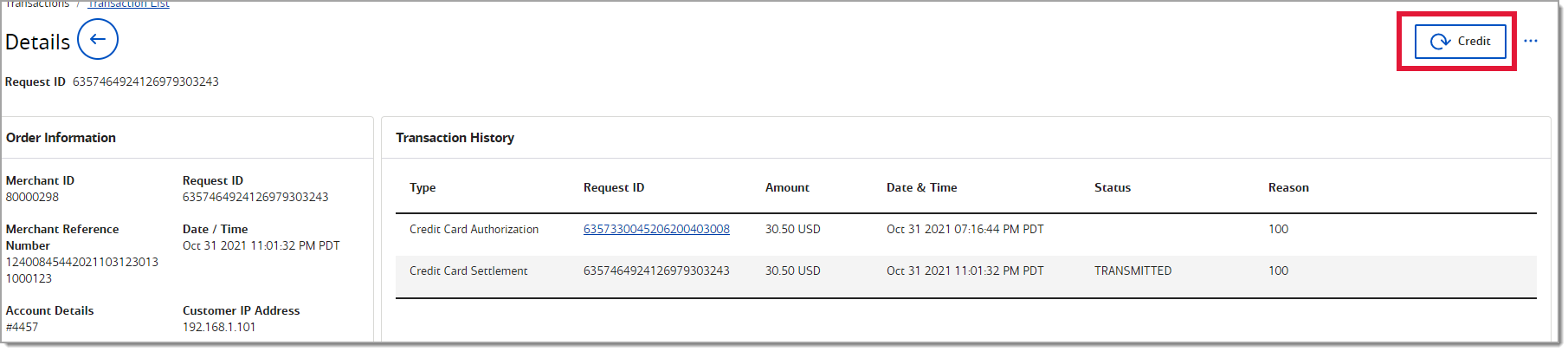

- Click Credit.

NOTE: The Credit button continues to display as long as the transaction can be credited. When the maximum amount is reached, the button will no longer appear.

- Enter the dollar amount that needs to be refunded to the cardholder.

Void recurring transactions

Voids will cancel out the settlement request if done on the same day the settlement was placed and before the transaction is batched out. Voids are available for transactions that are captured or marked for settlement.

IMPORTANT!

Credit refunds should never be completed by providing cash back to the cardholder.

- To void a recurring transaction

- Log in to your Merchant Services account in Business Advantage 360 online banking.

- From the left navigation, select Transactions. > Transaction List. A list of all transactions performed in the past 7 days displays.

- Click the Date Range filter to change this range as needed.

- Locate the transaction that you would like to review and select the hyperlink in the Request ID column. The Transaction Details page will display.

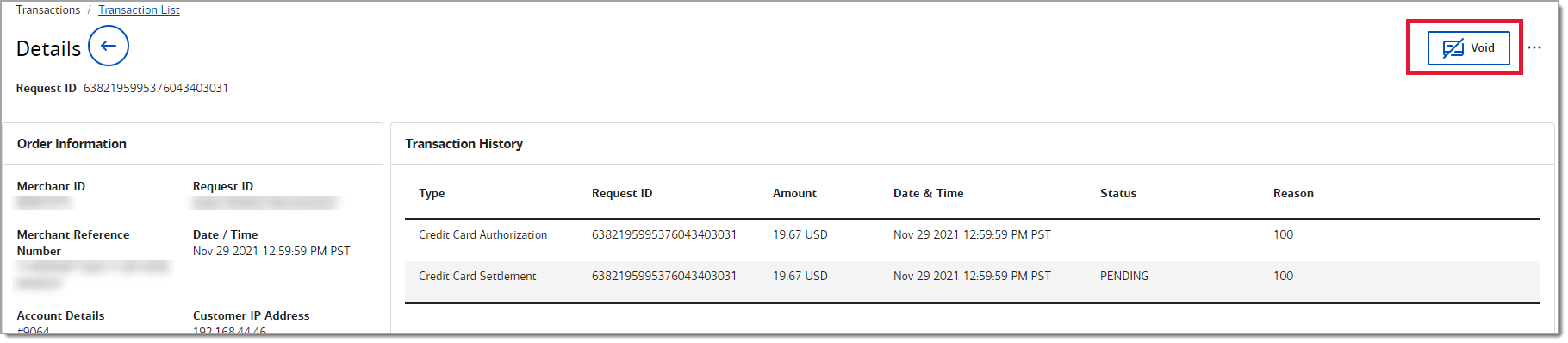

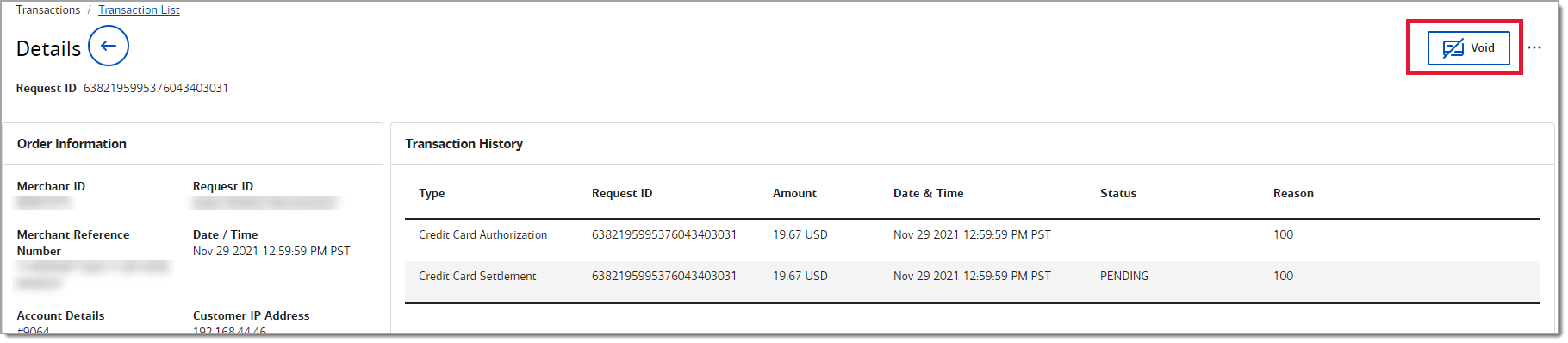

- Review the transaction details to ensure that the correct transaction has been selected. If the transaction has not moved to settlement, the ability to void will display. If the transaction has moved to settlement, the void option will not display. If void is not available, issue a credit.

- Click Void.

- Click Confirm to confirm the request. The transaction will be voided.

NOTE

This article is written for merchants who manage Recurring Billing within their Merchant Services account within Business Advantage 360. (Business Advantage 360 is our Small Business Online Banking platform.) This article is not written for advanced e-commerce merchants who integrate to the Bank of America Gateway via our Card Not Present Integration Toolkit, and manage this service via API.