Back Office Company-Level Tax Category Override

Description

What's in this article?

Solution: Essentials Light | Essentials | Retail | Restaurant

This feature enables individual stores within a multi-store environment to set the tax category for items to a different tax category than the global one set at the company level for the item. Tax Categories will still be global across all stores. The store can only set the tax category for an item to one that has already been created at the company level.

For example, a bracelet has a default tax category set to Standard Tax (7%). The Main street store leaves the bracelet’s tax category to Standard as this item is taxed in their state. The South street store, however, overrides the tax category for the bracelet to the Non-Tax category (0%) as the item is non-taxable in their state.

To override the tax category for an item

- In the Back Office, confirm you are in Store View for the selected store.

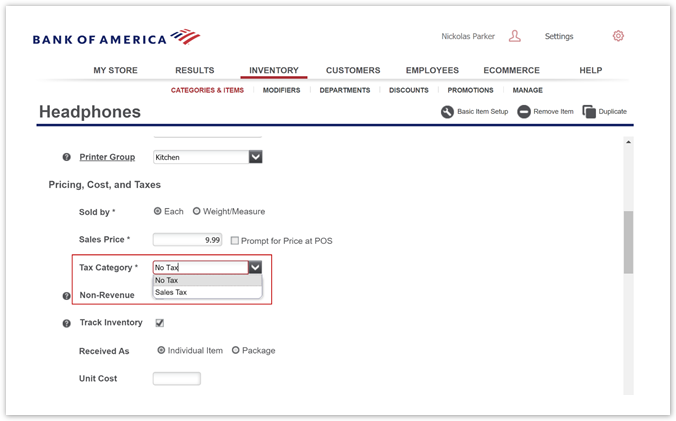

- Select the Inventory tab.

- Select the Categories & Items subtab.

- Click on the item to override.

- Select the Tax Category for the item from the dropdown list. The field will indicate that a store override has been set. If you select the default value, the store override is removed (and the text is removed as well).

- Click Save.