Merchant Services Statement Reconciliation

Description

How to reconcile your statements at the end of each month for your Merchant Services account

What's in this article?

Reconciliation matches statement information to your merchant account reporting. You will need reports from your Merchant Services account in online banking in addition to your monthly statement, to reconcile your monthly statement:.

To reconcile your Merchant Services statement

- Gather your reports and statements:

- Merchant Services Sales report

- Merchant Services Funded Deposits report

- Merchant Services Disputes report

- Merchant Services Adjustments report

- Merchant Services Fees report

- Merchant Services Charges report

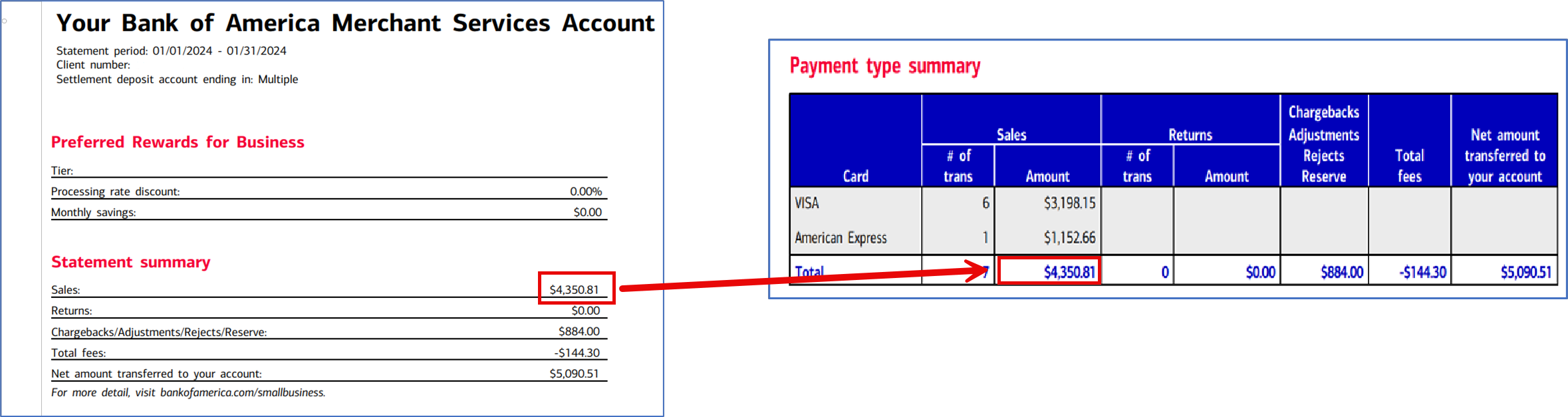

- Compare Statement Summary Sales to your Sales report total.

- Compare Statement Summary Returns total to your Returns report.

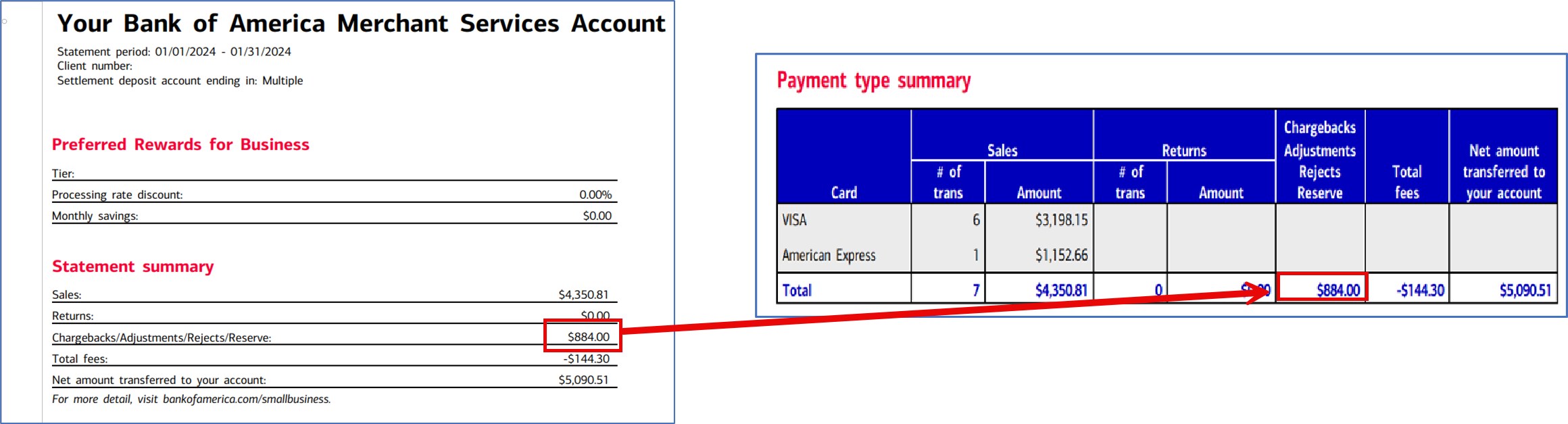

- Match Chargebacks/Adjustments/Rejects/Reserve total to the Payment Type Summary section totals.

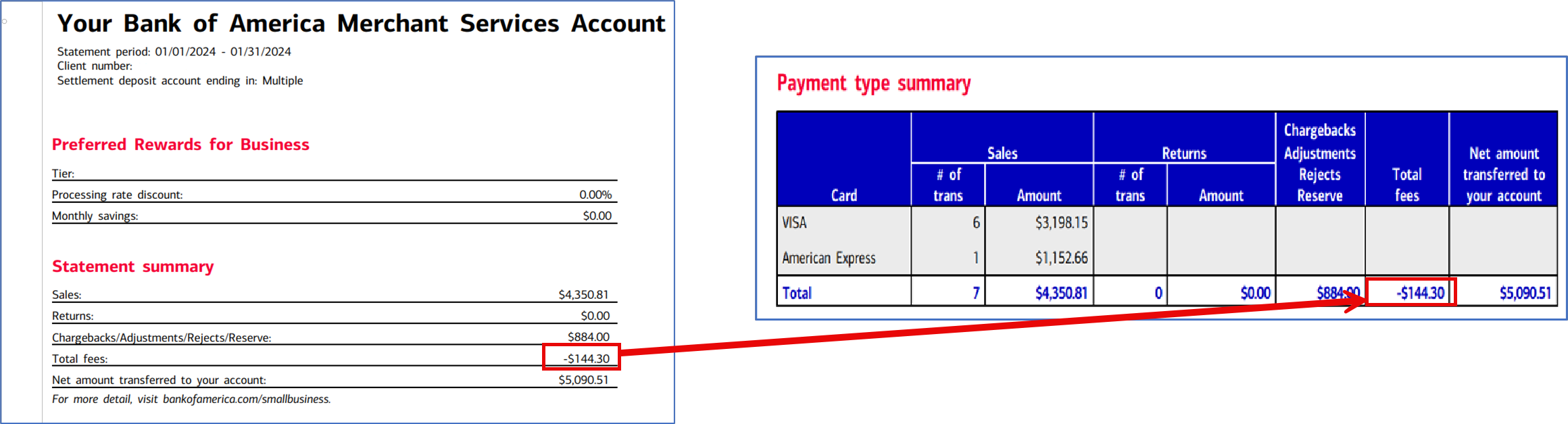

- Match Total fees in the Statement Summary to Total fees on the Payment Summary.

- Compare the Chargebacks/Reserve amount to the Transaction total on the Chargeback report.

- Adjustment total and filter by Card Type to validate the totals by card type.

- In the Daily Summary section of your statement, compare the Funded to deposit account column

- Validate the Funded to deposit account column on the statement.

- Compare each payment date on the Funded Deposit report from the portal to the Daily Summary section in statement.

Download the Fees report for the calendar month.

Validate the Fees in the Fee summary section on the statement.

Compare each fee listed on the statement with the details on the Fees report from the portal.

Download the Charges report for the calendar month.

Validate the Fees/charges listed in the Fee summary section of the statement.

Compare the fees/charges with the details on the Charges report.